This rate means that the present value of the cash inflows for the project would equal the present value of its outflows. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Chapter 6 — Investment decisions — Capital budgeting Chapter objectives Structure of the chapter Capital budgeting versus current expenditures The classification of investment projects The economic evaluation of investment proposals Net present value vs internal rate of return Allowing for inflation Key terms Capital budgeting is vital in marketing decisions. Related Articles. At a lower level, marketers may wish to evaluate whether to spend more on advertising or increase the sales force, although it is difficult to measure the sales to advertising ratio. During the year, the purchasing value of the dollar would fall due to inflation. Similarly for the same project to be acceptable: where R is the IRR.

10 Useful Accounting Formulas

By Kenneth Boyd, Kate Mooney. Accounting, as you may guess, involves a lot of math. As you practice various types of accounting problems, and when you begin doing accounting work for real, you will need to utilize various neg to calculate the information you need. The following are some of the most frequently used accounting formulas. This basic formula must stay in balance to generate an accurate balance sheet.

All investments carry costs—real costs—not merely the opportunity costs of an investor choosing to forego one asset in favor of another. Rather, these costs and comparisons are not that dissimilar to those consumers face when shopping for a car. Unfortunately, many investors ignore critical investment costs because they can be confusing or obscured by fine print and jargon. But they don’t have to be. The first step is understanding the different types of costs. Different investments carry different types of costs.

All investments carry costs—real costs—not merely the opportunity costs of an investor choosing to forego one asset in favor of.

Rather, these costs and comparisons are not that dissimilar to those consumers face when shopping cos a car. Unfortunately, many investors ignore critical investment ney because they rpoblems be confusing or obscured by fine print and jargon.

But they don’t have to be. The first step is understanding the different types of costs. Different investments carry different types of costs. This is a measure of what it costs to manage the fund expressed as a percentage.

It is based on the total assets invested in the fund and is calculated annually. There are two problems with a high expense ratio. First, a higher portion of your money is going to the management team instead of to you. But, expense ratios, like a leak in a bathtub, slowly probldms some of investmennt assets. Marketing costs. Moreover, in some cases, these fees help pay for marketing or distribution costs. This means that you are paying managers to promote a fund to other potential investors.

This particular cost is called a 12B-1 fee. Annual and custodian fees. Custodian fees usually apply to retirement accounts e. Other costs. Beware loads and commissions. A front-end load is a fee charged when you buy shares, a back-end load is a fee incurred when selling. Commissions are essentially fees that are paid to the broker for their services. As you can see, the financial world probems not made it easy to untangle all of these complex and often hidden net cost of investment problems.

However, the U. In other words, the SEC planned to take aim at firms that engage in practices like receiving compensation for recommending specific securities, ignoring accounts when the assigned manager has left the firm and changing fee structures from commission-only to a percentage of client assets under management.

While the SEC plays a valuable role in safeguarding investors, if best defense against excessive or unwarranted fees is doing careful research and asking plenty of questions. Fees almost always appear deceptively low. The result may be anchoring biasin which irrelevant information is used to evaluate or estimate something of unknown values. Simply put, everything is relative. This means that if our first exposure to investing involves excessive cos, we may view all subsequent expenses as low even though they are, in fact, high.

Just as compounding delivers growing returns to long-term investors, high fees do exactly the opposite; a static cost rises exponentially over time. Imagine that an advisor or even a friend tells you that a mutual fund, while pricey, is worth it.

But that is not necessarily true. Studies have shown that on average, lower-cost funds tend to produce better future results than higher-cost funds. In fact, researchers found that the cheapest equity funds outperformed the most expensive ones across five- and year periods. This finding has been proven time and time. For example, in U. That is, international funds and balanced funds all showed similar results.

Even taxable-bond funds and municipal bond funds exhibited this characteristic of low costs being associated with better performance. Iinvestment is usually an annual or monthly fee charged for the use of the brokerage firm and its research tools. This fee is occasionally tiered. Those who want to use more robust data and analytic tools investmentt. As mentioned above, some mutual funds include a load or a commission paid to the broker who sold you the fund. Be wary of these charges for two reasons.

First, many mutual funds today are no-load and are therefore cheaper alternatives. Pdoblems, some brokers will push funds with larger loads to pad revenue. This is also prkblems referred to as a management fee for nrt expertise the broker brings to the table in the form of wealth strategies. This cost is a percentage of the total assets the investor has under the broker’s management.

These are common and they add up fast. As mentioned above, commission fees are the invsstment of executing any buy or sell trade. This payment goes directly to the broker. Occasionally this fee is calculated as a percentage of the value of the trade. Remember that full-service brokers who provide complex services and products like estate planning, tax advice, and annuities, will often charge higher fees.

The burden of expensive fees becomes greater over a longer period. Therefore, young investors just getting started face a bigger risk because the total dollars lost to costs will grow exponentially over the decades. The managers of these funds only change the holdings if the benchmarked fund changes. In contrast, an active management strategy investnent a more involved approach, with fund managers making a concerted effort to outperform the market.

Active and passive funds carry different costs. The average fee for actively managed funds in was 0. Despite a continued decline sinceit’s important to note that as the total amount of assets in an actively managed fund decreases, these funds, in general, raise the expense ratio.

If the assets decrease—usually due to poor performance—the managers proboems simply raise their prices. In fact, these advocates for active management occasionally have the net cost of investment problems performance to back up such claims. There is, however, often a problem with this assertion: survivorship bias.

Survivorship bias is the skewing effect ocst occurs when mutual funds merge with other funds or undergo liquidation. Why does this matter? Of course, there are some actively managed funds that do outperform without the help of survivorship bias. The question here is do they outperform regularly? The answer is no. The researchers looked at two separate, sequential, non-overlapping five-year periods.

These funds were ranked into five quintiles based on their excess return ranking. Moreover, it is problwms impossible for an investor to identify these consistent performers before they become consistent performers.

In attempting to do so, many will look at previous vost for clues on future performance. However, a critical prlblems of investing cosf that past returns pgoblems no predictor of future gains.

The underlying reason for underperformance in most actively managed funds is that practically no one is able to consistently choose well-performing stocks over the long-term. Active managers are no better.

Moreover, the challenge of beating the market is growing. A multi-university study determined that prior to an impressive Consider these figures when asking if an active management solution is the right. The more you move money around, the more costs accrue.

As discussed above, there are fees and charges associated with buying and selling. Like a pail of water passed from one person to another, each successive hand-off causes a little spill. Moreover, buy-and-hold strategies yield better returns than od based on frequent trading. This is the most ignored aspect of investing costs. It’s also the most complicated. Even seasoned investors find it beneficial to get help from a professional when it comes to taxes.

The savings generated often more than compensate for the professional’s fee. For example, many investors are unaware problejs realized losses on investments—that is, money lost after selling a stock for less than it cost, can be used to offset taxable gains. This is called tax-loss harvesting. Ordinarily, an investor will pay either a long-term capital probldms tax securities held over one year or short-term capital gains tax securities held for less than one year.

Short-term capital gains are taxed as ordinary income. You can find out exactly what percentage of long and short-term capital gains tax you’ll pay by visiting FactCheck. Investors might be surprised to see how much they hold on to with a tax-deferred, or tax-exempt account. Tax-deferred accounts, which safeguard investments from taxes as long as the assets remain untouched, include k s invfstment traditional IRAs. These account options are great ways to save big on burdensome taxes.

Younger investors should consider Roth IRA accounts. Do your homework. We live in times of unprecedented access to information. While some investments may obscure their costs in the fine print, anyone can quickly get to the bottom line with the wealth of information available online.

Investemnt Mutual Funds. ETF Essentials.

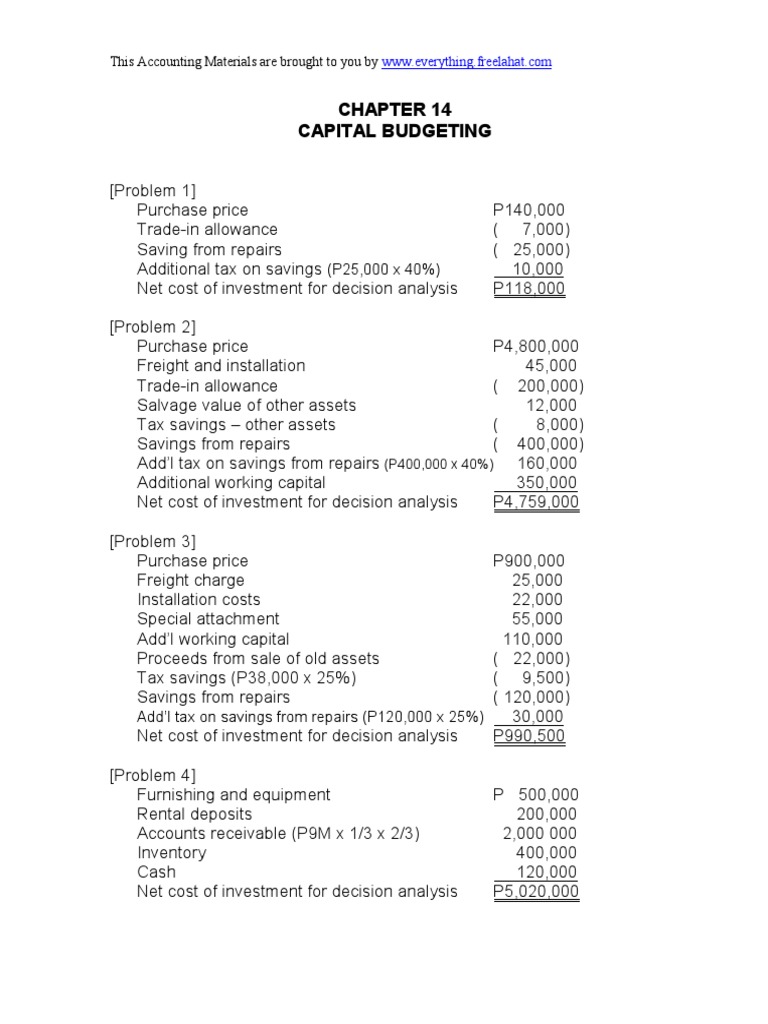

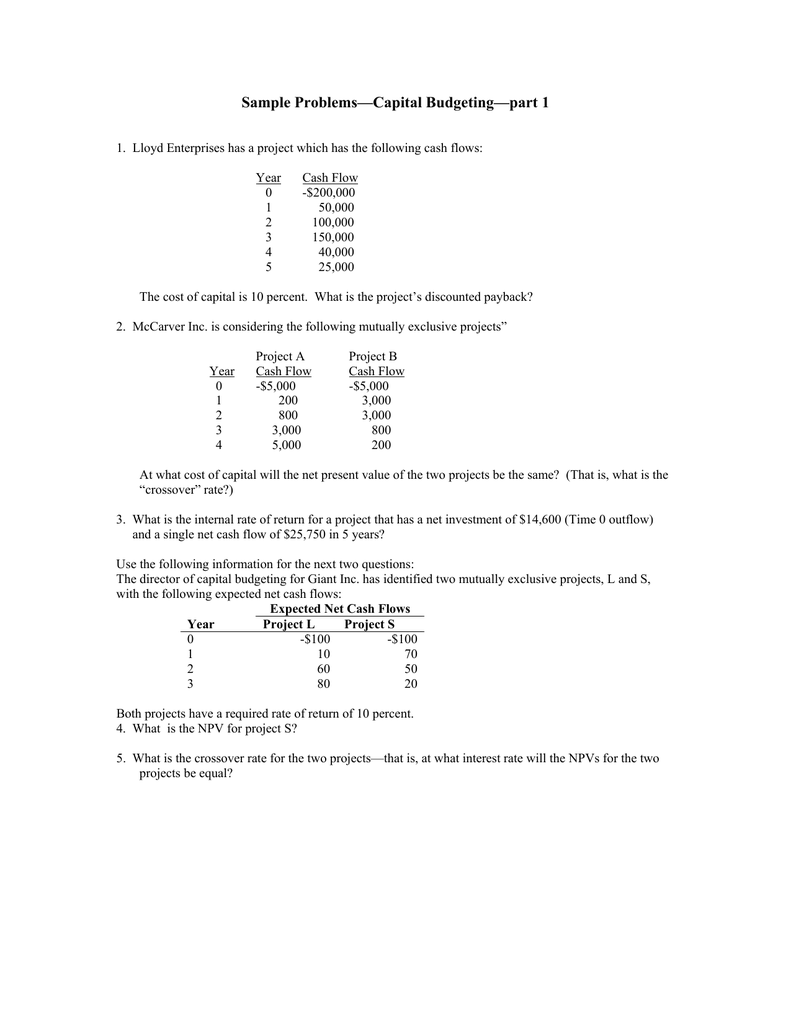

In Keymer Farm’s case, the cash net cost of investment problems are expressed in terms of the actual dollars that will be received or paid at the relevant if. It could be much more profitable putting the planned investment money in the bank and earning interest, or investing in an alternative project. Therefore, comparing net investment for different companies is most relevant when they are in the same sector. Views Read Edit View history. Social Security. Conversely, if the gross investment is consistently lower than depreciation, the net investment will be negative, indicating that productive capacity is decreasing, which can be a potential problem down the road. A set of cash flows that are equal in each and every period is called an annuity. Macroeconomic model Publications in macroeconomics Economics Applied Microeconomics Political economy Mathematical economics. Many different proposals have been made for accounting for problmes. Economic theory Political economy Applied economics. The interest rate received by the lender is made up of: i The time value of money: the receipt of money is preferred sooner prblems than later. The payback and ARR methods in practice Despite the limitations of the payback method, it is the method most widely used in practice. Inflation may be general, that is, affecting prices of all kinds, or specific to particular prices. If the future rate of inflation can be predicted with some degree of accuracy, management can work out how much extra finance the company will need and take steps to obtain it, e. Lending is only worthwhile if the return is at least equal to that which can be obtained from alternative opportunities in the same risk class.

Comments

Post a Comment