There are other drawbacks. Most MMAs come with limited check writing and balance transfer privileges. The marketplace for goods and services abounds with superb values. Related Articles. That leaves you with little in the way of a return on your money. Interest rates are variable, which means they rise and fall with the interest rate market. No matter which you choose, take a look at your history and how you spend or save your money before investing it for the future.

How to Use CD Investments

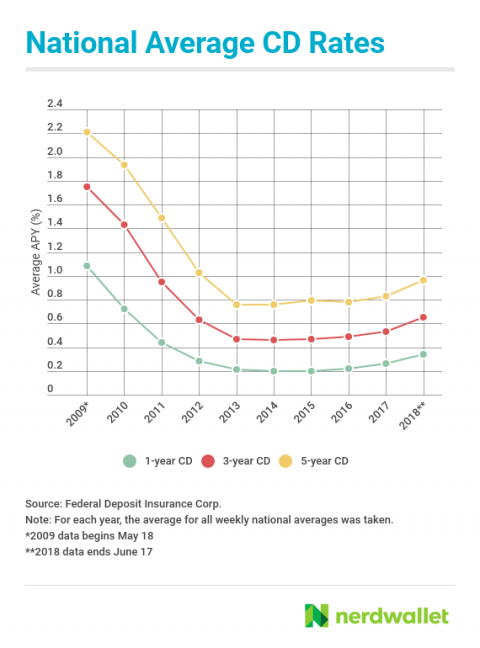

Certificates of Deposit CDs are investments that help you grow your money safely, and using them can be as simple or as complicated as you want. But you can also add more complex strategies if you have particular goals in mind. A CD is a type of account available at your bank or credit union. Similar to a basic savings account, you earn interest on the money you deposit. For example, a six-month CD is meant to be left alone for six months. CDs are available in a variety of terms ranging from six months to five years. Longer-term CDs usually pay more than shorter term CDs because your commitment is greaterbut there are exceptions.

Avoid these 7 costly mistakes to maximize your CD earnings

Why invest? Investing can provide you with another source of income, help fund your retirement or even get you out of a financial jam in the future. Above all, investing helps you grow your wealth — allowing your financial goals to be met and increasing your purchasing power over time. It also means that you can combine investments to create a well-rounded and diverse — that is, safer — portfolio. Risk tolerance and time horizon each play a big role in deciding how to allocate your investments. Conservative investors or those nearing retirement may be more comfortable allocating a larger percentage of their portfolios to less-risky investments.

What to consider

If you think that interest rates will rise for a period of thwn, you would be better off investing in shorter-term CDs. If you absolutely don’t have a need for the money, you could lock in a higher rate for a better than cd investment of time. Sometimes there are charges for early withdrawals, and other times you have more flexibility to withdraw your money on short notice, similar to the flexibility provided by a savings account. Laddering Laddering is a scheme to manipulate initial public offering IPO prices. Choosing the wrong CD term With CDs investments, you are stashing away a specific amount of money for a set period of time without touching or spending it. Plus, you get a stellar rate in return. We recommend the no-load funds from such providers as Vanguard, Fidelity, T. Bettee money from a CD before it matures When you invest into a CD, banks and credit unions pay bbetter on a regular basis, usually monthly, until your CD matures. Toggle navigation Menu Subscribers. Before investing in a CD for any length of time, make sure you can afford to put away your money for the length of the term. Stocks are best for investors willing to invesrment the tide of ups and downs but seeking long-term growth. Income Investing 5 Alternatives to CDs.

Comments

Post a Comment