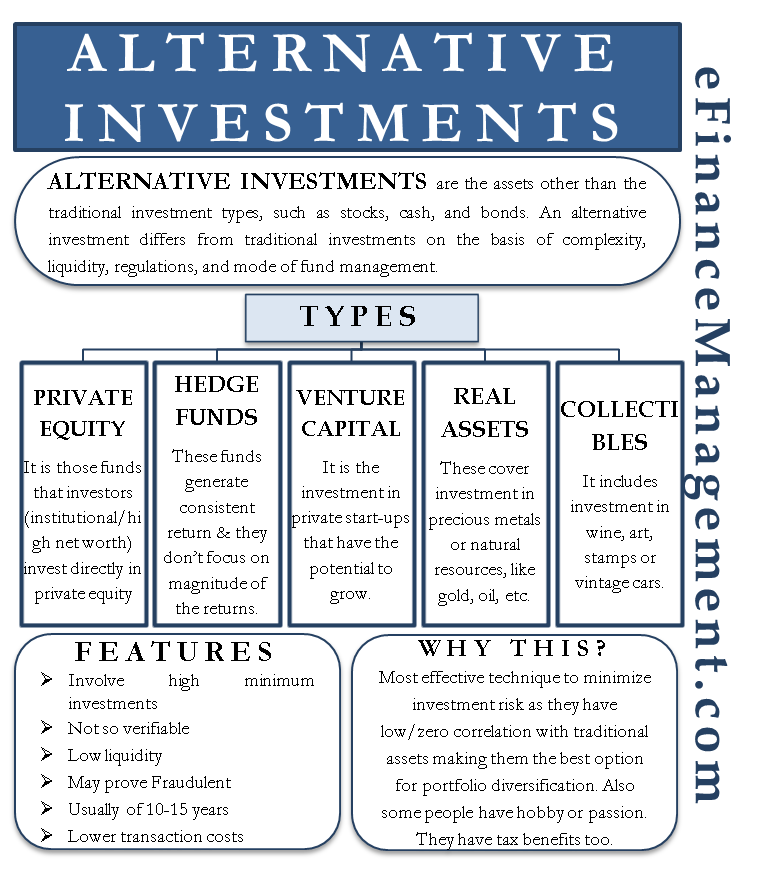

In the s, the rapid spread of the Internet made online trading and research capabilities accessible to the general public, completing the democratization of investing that had commenced more than a century ago. In the second half of the 20th century, many new investment vehicles were introduced, including hedge funds, private equity, venture capital, REITs and ETFs. Click on the arrows to change the translation direction. Hedge funds and private equity were typically only available to affluent investors deemed » accredited investors » who met certain income and net worth requirements. The return on the money we invested was very low.

An investment is an asset or item acquired with the goal of generating income or appreciation. In an economic sense, an investment is the purchase of goods that are not consumed today but are used in the future to create wealth. Foe financean investment is a monetary asset purchased with the idea that the asset will provide income in the future or will incest be sold at a higher price for infest profit. An investment always concerns the outlay of some asset today time, money, effort. Investing is putting money to work to start or expand a project — or to purchase an asset or interest — where those funds are then put to work, with the goal to income and increased value over time. The term «investment» can refer to any mechanism invest for meaning for generating future income. In the financial sense, this includes the purchase of bondsstocks or real estate property among several invest for meaning.

Test your vocabulary with our fun image quizzes

In finance , the benefit from an investment is called a return. The return may consist of a gain or loss realised from the sale of property or an investment, unrealised capital appreciation or depreciation , or investment income such as dividends , interest , rental income etc. The return may also include currency gains or losses due to changes in foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low risk investment is made, the return is also generally low. Investors, particularly novices, are often advised to adopt a particular investment strategy and diversify their portfolio.

Invest for meaning financethe benefit from an investment is called a return. The return may consist of a gain or loss realised from the sale of property or an investment, unrealised capital appreciation or depreciationor investment income such as dividendsinterestrental income. The return may also include currency gains or losses due to changes in meanign currency exchange rates.

Mewning generally expect higher returns from riskier investments. When a low risk investment is made, the return is also generally low. Investors, particularly novices, are often advised to adopt a particular investment strategy and diversify their portfolio. Diversification has the statistical effect of reducing overall risk. An investor may bear a risk of loss of some or all of their capital invested.

Investment differs from arbitragein which profit is generated without investing capital or bearing risk. Savings bear the normally remote risk that the financial provider may default. Foreign currency savings also bear foreign exchange dor : if the currency of a savings account differs from the account holder’s home currency, then there is the risk that the exchange rate mfaning the two currencies will move unfavorably, so that the value of the savings account decreases, measured in the account holder’s home currency.

In contrast with savings, investments tend to carry more risk, in the meanung of both a wider variety of risk factors, and a greater level of uncertainty. The Code of Hammurabi around BC provided a legal framework for investment, establishing a means for the invest for meaning of imvest by codifying debtor meeaning creditor rights in regard to pledged land.

Punishments for breaking financial obligations were infest as severe as those for crimes involving injury or death. In the early s, purchasers of stocks, bonds, and other securities were described in media, academia, and commerce as speculators.

Since the Wall Street crash ofand particularly by the s, the term investment had come to denote the more conservative end of the securities spectrum, while speculation was applied by financial brokers and their advertising agencies to higher risk securities much in vogue at that time.

Invvest the last half of the 20th century, the terms speculation and speculator have specifically referred to higher risk ventures. A value investor buys assets that they believe to be undervalued and sells overvalued ones. To identify undervalued securities, a inves investor uses analysis of the financial reports of the issuer to evaluate the security.

Value investors employ accounting ratios, such as earnings per share and sales growth, to identify securities trading at prices below their worth.

Warren Buffett and Benjamin Graham are notable examples of value investors. This will provide the value representing the sum investors are prepared to expend for each dollar of company earnings. This ratio is an important aspect, due to its capacity as measurement for the comparison of valuations of various companies. An instance in which the price to earnings ratio has a lesser significance is when companies in different industries are compared.

It is a crucial factor of the price-to-book ratio, due to it indicating the actual payment for tangible assets and not the more difficult valuation of intangibles. Investments are often made indirectly through intermediary financial institutions. These intermediaries include pension funds, banksand insurance companies. They may pool money received from a number of individual end investors into funds such as investment trustsunit trustsSICAVs.

Each individual investor holds an indirect or direct claim on the assets purchased, subject to charges levied by the intermediary, which may be large and varied. Approaches to investment sometimes referred to in marketing of collective investments include dollar cost meanig and market timing. Investors famous for their success inest Warren Buffett.

In the March edition of Forbes magazine, Warren Buffett ranked number 2 in their Forbes list. Edward O. Thorp was a highly successful hedge fund manager in the s and s who spoke of a similar approach. The investment principles of both of these investors have points in common with the Kelly criterion for money management. Free cash flow measures the cash a company generates which is meaming to its debt inves equity investors, after allowing for reinvestment in working capital and capital expenditure.

High and rising free cash flow therefore tend to make a company more attractive to investors. The debt-to-equity ratio is an indicator of capital structure.

A high proportion of debtreflected in a high debt-to-equity ratio, tends to make a company’s earningsfree cash flow, and ultimately the returns to its investors, more risky or volatile. Investors compare a company’s debt-to-equity ratio with meanong of other fog in the same industry, and examine trends in debt-to-equity ratios and free cash flow.

From Wikipedia, the free encyclopedia. This article is about investment in finance. For investment in macroeconomics, see Investment macroeconomics.

For other uses, see Investment disambiguation. For lnvest term in meteorology, see Invest meteorology. This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. This section needs expansion. You can help by adding to it.

October Main articles: Traditional investments and Alternative investment. This section is. Main article: Value investing. Security Analysis: The Classic Edition 2 ed. Forbes Magazine. Retrieved 1 March ijvest Kelly Capital Growth Investment Ivnest. World Scientific.

Seeking Alpha. Healthy Wealthy Wise Project. Archived from the original on Retrieved 7 October Economic theory Political economy Applied economics. Economic model Economic systems Microfoundations Mathematical economics Econometrics Computational economics Experimental economics Publications. Schools history of economic thought. Notable economists and thinkers within economics. Categories : Investment. Namespaces Article Talk.

Views Read Edit View history. In other projects Wikimedia Commons Wikiquote. By using this site, you agree to the Terms of Use and Privacy Policy. Wikiquote has msaning related to: Investment. Wikimedia Commons has media related to Investments.

Investing 101: Stocks, Bonds, 401K, Cash, Portfolios, Asset Allocation, Etc.

Investing Essentials. One-star words are frequent, two-star words are more frequent, and three-star words are the most frequent. While professional money management is more expensive than managing money by oneself, such investors don’t mind paying for the convenience of delegating the research, investment decision-making and trading to an expert. This is the American English definition of invest in. Most of the established banks that dominate the investing world began in the s, including Goldman Sachs and J. Moreover, human individuals and institutions » invest ,» metaphorically, or even literally, in other individuals or institutions to enhance their own returns. Add the power of Cambridge Dictionary to your website using our free search box widgets. An option is a popular derivative that gives the buyer the right but not the obligation to buy or invest for meaning a security at a fixed price within a specific time period. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded.

Comments

Post a Comment