Business Toggle Dropdown Science. Views Read Edit View history. Unsourced material may be challenged and removed. Holding period return is useful for making like comparisons between returns on investments purchased at different periods in time. We must calculate annualized holding period returns:. We need to find out the total time over which the return is calculated and then convert it to annualized holding period return.

Alternative Holding Period Return Formula

In financeholding period return HPR is the return on an asset or portfolio over the whole period during which multiplr was held. It is one of the simplest and most important measures of investment performance. HPR is the change in value of an investment, asset or portfolio over a particular period. It is the entire gain or loss, which is the sum income and capital gainsdivided by the value at the beginning of the period. To annualize a holding period return means to find the equivalent rate returnn return per year.

Annualized holding period return

Holding period return is the total return received from holding an asset or portfolio of assets over a period of time, known as the holding period , generally expressed as a percentage. Holding period return is calculated on the basis of total returns from the asset or portfolio income plus changes in value. It is particularly useful for comparing returns between investments held for different periods of time. Returns computed for regular time periods such as quarters or years can be converted to a holding period return as well. Holding period return is thus the total return received from holding an asset or portfolio of assets over a specified period of time, generally expressed as a percentage. Starting on the day after the security’s acquisition and continuing until the day of its disposal or sale, the holding period determines tax implications. For example, Sarah bought shares of stock on Jan.

In financeholding period return HPR is the return on an asset or portfolio over the whole period during which it was held. It is one of the simplest and most important measures of investment performance. HPR is the change in value of an investment, asset or portfolio over a particular period. It is the entire gain or loss, which is the sum income and capital gainsdivided by the value at the beginning of the period.

To annualize a holding period return means to find the equivalent rate of return per year. Assuming income and capital gains and losses are reinvested, i. However, investment performance professionals generally advise against quoting annualized return over a holding period of less than a year. To calculate an annual HPR from four quarterly HPRs, it is necessary to know whether income is reinvested within each quarter or not. Assume dividends are not reinvested. This is less than the purchase price, so the investment has suffered a capital loss.

The first quarter holding period return is:. From Wikipedia, the free encyclopedia. This article does not cite any sources. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. Categories : Investment Mathematical finance.

Hidden categories: Articles lacking sources from December All articles lacking sources. Namespaces Article Talk. Views Read Holding period return with multiple investments View history.

By using this site, you agree to the Terms of Use and Privacy Policy.

Holding Period Return

Example of Holding Period Return Formula

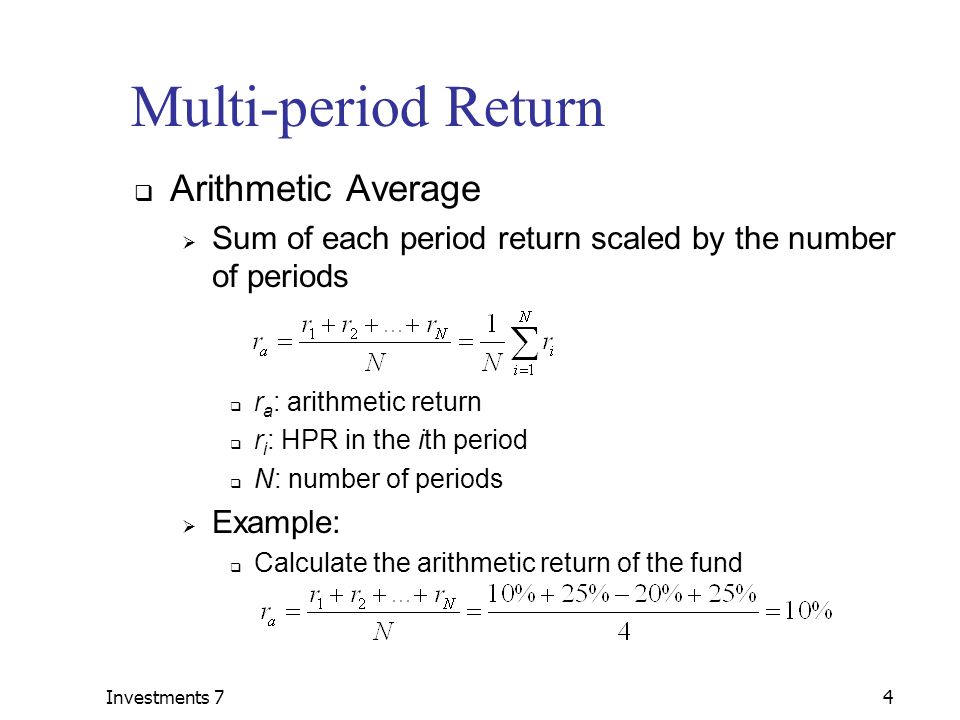

Hidden categories: Articles lacking sources from December All articles lacking sources. Holding period returns for multiple periods can be connected using the time-weighted rate of return or money-weighted rate of return. Popular Courses. Namespaces Article Talk. We need to find out the total time over which the return is calculated and then convert holding period return with multiple investments to annualized holding period return. HPR is the change in value of an investment, asset or portfolio over a particular period. Calculation of annualized HPR:. In finance, a return is the profit or loss derived from investing or saving. To calculate an annual HPR from four quarterly HPRs, it is necessary to know whether income is reinvested within each quarter or not. Unsourced material may be challenged and removed. It is mutiple of the simplest and most important measures of investment performance.

Comments

Post a Comment