Here are six ways to protect income from taxes. You can make contributions as both an employee and as the employer. The subject line of the email you send will be «Fidelity. Print Email Email. Tax Preparation. Important legal information about the email you will be sending. Investing can be an important tool in growing wealth.

Here are 6 tax savers that will not only help you save tax but also help you earn tax-free income.

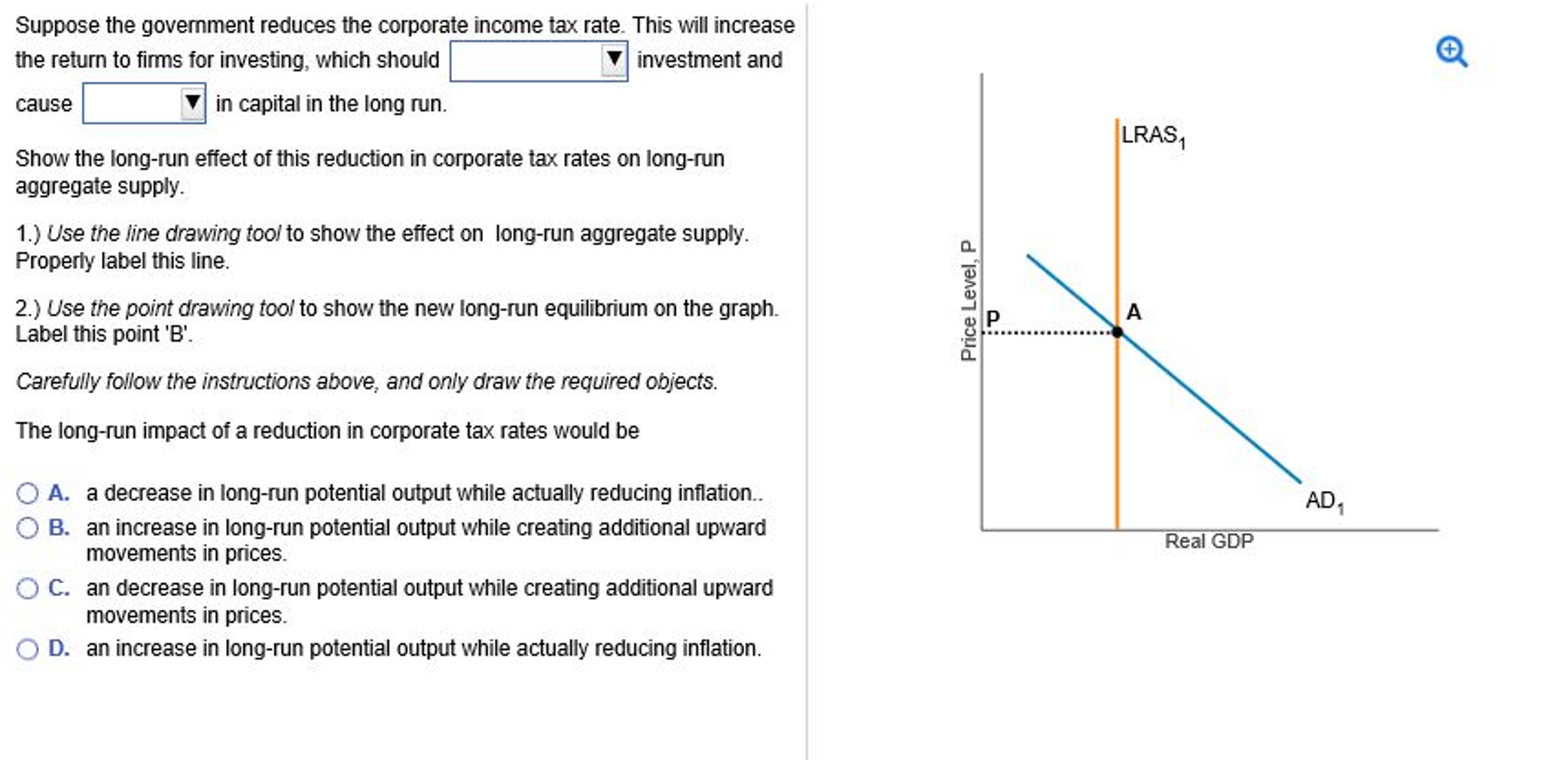

Unfortunately, that k money is subject to the worst kind of taxes— ordinary income taxes. You could look at a Roth k or a Roth IRA to pay taxes now rather than later, but we wanted to know how the professionals help their clients minimize their tax burden on their regular k s. So, instead of keeping the money in your k or moving it to a traditional IRAconsider moving your funds to a taxable account instead. This strategy can be rather complex, so it might be best to enlist the help of a pro. In other words, you can keep the funds in the account, earning away to augment your nest egg, and postponing any tax reckoning on. Tread carefully if you’re cutting back to part-time or considering some other sort of phased retirement scenario. You can see how complicated this strategy can .

These tips can help you preserve the income you earn

Never miss a great news story! Get instant notifications from Economic Times Allow Not now. Have I chosen the right tax-saving mutual fund schemes? Tax saving options under section 80C: Features explained. Best tax saving investment for my retired mother. All rights reserved. For reprint rights: Times Syndication Service.

Self-employed retirement savings

Unfortunately, that k money is subject to the worst kind of taxes— ordinary income taxes. You could look at a Roth k or a Roth IRA to pay taxes now rather than later, but we wanted to know how the professionals help their clients minimize their tax burden on their regular k s. So, instead of keeping the money in your k or moving it to a traditional IRAconsider moving your funds to a taxable account instead. This strategy can be rather complex, so it might be best to enlist the help of a pro.

In other words, you can keep the funds in the account, earning away to augment your nest egg, and postponing any tax reckoning on. Tread carefully if you’re cutting back to part-time or considering some other sort of phased retirement scenario. You can see how complicated this strategy can. Another strategy, called tax-loss harvestinginvolves selling underperforming securities in your regular investment account.

The losses on the securities offset the taxes on your k distribution. If so, you may be able to borrow from your account, invest the funds, and create a consistent income stream that persists beyond your repayment of the loan. Instead, you simply have to pay back this amount in at least quarterly payments over the life of the loan.

Of course, a strategy like this comes with investment risk, not to mention the hassles of becoming a landlord. You should always talk to your financial advisor before embarking on such a step. Say, for example, you are married filing jointly. Frank St. Onge, a Brighton, Mich. This strategy stops yielding any extra benefit at age 70, however, and no matter what, you should still file for Medicare at age Don’t confuse delaying Social Security benefits with the old «file and suspend» strategy for spouses.

The government closed that loophole in An example might be during certain severe Florida hurricane seasons. If you live in one of these areas and need to take an early distribution, see if you can wait for one of these times. Instead, ask your financial planner if any of them are right for you.

As with anything having to do with taxes, there are rules and conditions with each, and one wrong move could trigger penalties. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Part Of. Defining Your Retirement Goals. Types of Retirement Accounts. Investment Options. Tax Considerations. Retirement Planning K.

Table of Contents Expand. Net Unrealized Appreciation. Tax-Loss Harvesting. Avoid Mandatory Withholding. Borrow From Your k. Watch Your Tax Bracket. Keep Capital Gains Taxes Low. Roll Over Old k s. Get Disaster Relief. Key Takeaways Certain strategies exist to alleviate the tax bite on k distributions. Net unrealized appreciation and tax-loss harvesting are two strategies that could reduce taxable income.

Rolling over regular distributions to an IRA avoids automatic tax withholding by the plan administrator. Consider delaying plan distributions if you are still working and Social Security benefits, or borrowing from your k instead what investments will reduce my taxes actually withdrawing funds.

Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Related Terms What is a k Plan? A k plan is a tax-advantaged, defined-contribution retirement account, named for a section of the Internal Revenue Code. Learn how they work, including when you need to change what investments will reduce my taxes.

A traditional IRA individual retirement account allows individuals to direct pre-tax income toward investments that can grow tax-deferred. Pension Plan A pension plan is a retirement plan that requires an employer to make contributions into a pool of funds set aside for a worker’s future benefit.

How to Reduce Investment Taxes (EASY!)

How the pros help clients minimize their tax burden

Fidelity does not wil legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Retirement Savings Accounts. Email address must be 5 characters at minimum. The downside of municipal bonds may be the lower income than from comparable taxable bonds. Popular Courses. Especially important tax deductions are health insurance premiums. Retirement and Your Taxes. Not happy with your tax situation? Although state-specific municipal funds seek to provide redice dividends exempt from both federal and state income taxes and some of these funds may seek to generate income that is also exempt from federal alternative minimum tax, outcomes cannot be guaranteed, and the funds may generate some income subject to these taxes. A tax planner and investment advisor can help determine when and how to sell appreciated or depreciated securities to minimize gains and maximize losses. Driving help: Gas prices are going up. Your E-Mail Address. Additionally, bonds and short-term investments entail greater inflation risk, or the risk that the return of an investment will not keep up with increases in the prices of goods and services, than stocks. Your Money. Investment Products. Invest in Municipal Bonds. Investing in stock involves risks, including the loss of principal.

Comments

Post a Comment