Her Majesty’s Treasury. Archived here. Category Commons.

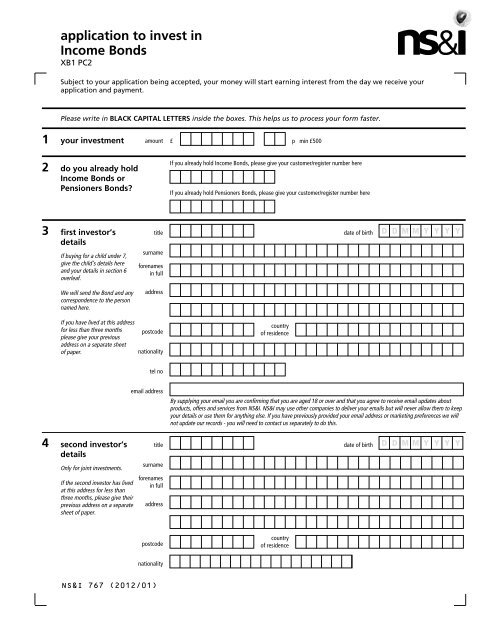

Eligibility & Where You Can Apply for the National savings and Investments (NS&I) Bond

But the HM Treasury-backed body also offers a number of other savings options. It offers products online, over the phone and by post and over 25 million customers in the UK save and invest with it. It’s important to compare savings accounts, Individual Savings Accounts Isas and bonds to find the right product for your situation. For some accounts, although the interest is taxable it’s paid without the tax taken off. This means you’ll need to declare the interest to HMRC each year on a tax return and pay any tax .

Cash ISAs with NS&I

These bonds are available to anyone who is aged above 16, with any UK bank account. This body often changes its products. At this given point in time, you can get these following products:. It has an odd name as people are not actually making any investment on anything. When there is an investment, people usually take some risk such as purchase of shares where it is possible and the value may fluctuate. In investment bond however, you simply need to save and get interest on those savings. As already mentioned earlier, the Investment bond can be purchased by anyone who is above 16 years of age.

A winning gift

These bonds are available to anyone who is aged above 16, with any Savimgs bank account. This body often changes its products. At this given point in time, you can get these following products:. It has an odd name as people are not actually making any investment on.

When there is an investment, people usually take some risk such as purchase of shares where it is possible and the value may fluctuate.

In investment bond however, you simply need to invesyment and get interest on those savings. As already mentioned earlier, the Investment bond can be purchased by anyone who is above 16 years of age.

This is the sole criteria and there are no other restrictions on who can open it. All you need to do is apply online. However, here are some of the few important points which you need to keep in mind when applying for the bond:. Though locking up your money for such an extensive period can lead to few risks such as:. Inflation could hamper the returns: With the increase in inflation, it may happen that it ends up diminishing the value of your money.

However, if it remains one of the highest savings accounts, you would always be happy sticking to the cash savings. You can naional for this option only if you find a better-paying account. This, in turn, implies investmeny Government is giving back something to almost everyone who is hard-hit by lower rates of.

Interest rate, however, is paid annually and added to the amount saved. This way you get lesser interest, but on a larger. You can also check whether you can get a better rate at a high-interest bones account.

So, you can choose to get a higher rate of interest on the same amount of savings. Just like the Pensioner Investjent, the Investment Bonds now are taxable.

The interest from the investment bond nationaal, is tax-free. The interest in fact, is covered by bonrs saving allowance. This means that you can earn lesser interest in investmejt compared to your allowance. In case the interest from the investment bond combined with other savings takes you over your personal savings allowance, The HMRC will collect any tax you owe.

This fund ensures that if the bank or institution collapses, you can get some savihgs your money. Thus, your money is totally secure. One of the significant reasons for the popularity of National Savings and Investment is that it is Government backed and offers the savers complete peace of mind. This offers the savers complete peace of mind. So, go for it!

One of easiest way to check if you have won is to use NSandI prize checker app. Get the prize checker app on the App Store. Get the prize checker app on Google Play. Check my prizes online. Downloads and forms. Click here for Review Overall Score 3. Vidit Agarwal. Click here for Review.

HMRC Offices. Share this post. Previous Post. Next National savings and investment bonds. Thank you for your feedback. An error occured!. Rate it! Save Changes. Sign up to our newsletter Tax news for contractors freelancers and small businesses.

What Is A Bond? 📈 BONDS FOR BEGINNERS!

What is National Savings and Investments (NS&I) ?

Archived. Interest is paid monthly straight into your bank or building society account. You can have more than one account. Headquarters: 1, Horse Guards Road. Please improve this by adding secondary or tertiary sources.

Comments

Post a Comment