There are still some boutique firms that might be hiring, so it is worth reaching out to them to see. Leave a Comment. Revoke Cookies. But the burnt out analyst didn’t show up. They do that by using existing contacts and relationships, working on only inbound deals, and avoiding all pitches. You mentioned how hard it is to divide labors, which makes sense. One told me that they hadn’t figured out the concepts of genuine work and sacrifice.

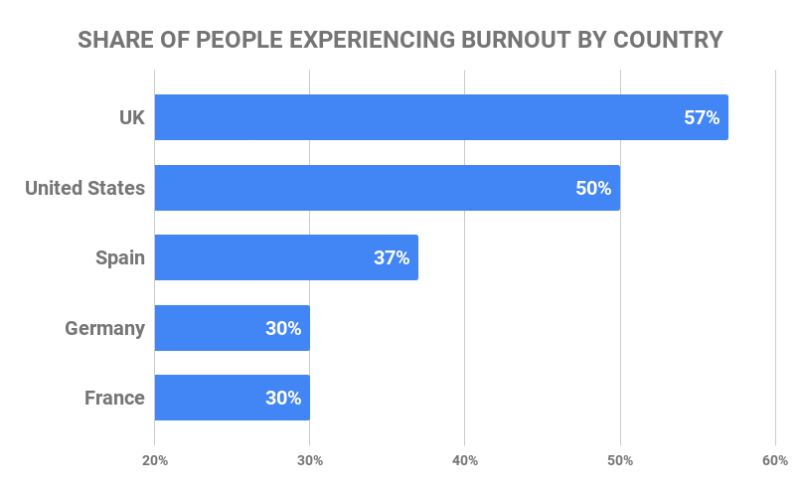

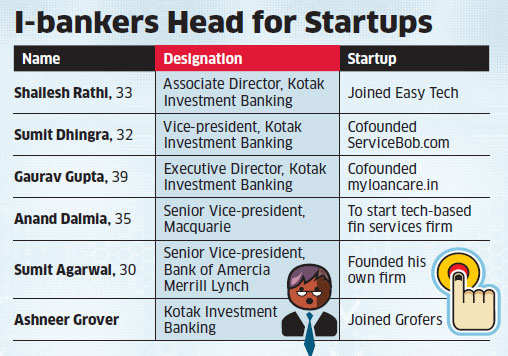

Deal makers joining this exodus is a reflection of global trends, with investment banking acting as a springboard for their new careers.

Corporate finance and investment banking aren’t all that different in a general sense. Investment banks raise capital for other companies through securities investmrnt in the debt and equity markets. They offer advisory services to big clients and perform complex financial analyses. A generally accepted distinction between corporate finance jobs and investment banking jobs is that a corporate finance professional deals with day-to-day financial operations and handles short- and long-term business goals, while an investment burnout rate investment banking focuses on raising capital. Investment banking grows a company.

Site Index

An Investment bank is a financial services company or corporate division that engages in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with corporate finance , such a bank might assist in raising financial capital by underwriting or acting as the client’s agent in the issuance of securities. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket upper tier , Middle Market mid-level businesses , and boutique market specialized businesses. Unlike commercial banks and retail banks , investment banks do not take deposits.

What Do “Investment Banking Hours” Mean?

The burnout rate investment banking market crash has become a distant memory, and home prices are looking healthy. And a stronger economy has helped bring out new investors who are looking to make real estate a part of their investment portfolio. A little creativity and preparation can bring financing within reach for many real estate investors. If you can put down 25 percent, you may qualify for an even better interest rate, according to mortgage broker Todd Rafe, president of Huettner Capital in Denver.

That can be a powerful incentive, and a larger down payment also provides the bank greater security against losing its investment. That can range from one-quarter vanking a point burnoout 2 points to keep the same rate. A point is equal to one percent of the burnuot loan.

The alternative to paying points if your score is below is to accept a higher interest rate. In addition, having reserves in the bank to pay all your expenses — personal and investment-related — for at least six months has become part of the lending equation.

They also may know the local market better and have more interest in investing locally. Mortgage brokers are another good option because they have access to a wide range of loan products — but burrnout some research before settling on one. Do they belong to any professional organizations? You have to do a little bit of due diligence.

In the days when almost anyone could qualify for a bank loan, a request for owner financing used to make sellers suspicious of potential buyers. However, you should have a game plan if you decide to go this route. Financing for the actual purchase of the property might be rste through private, personal loans from peer-to-peer lending sites butnout Prosper and LendingClub, which connect investors with individual rzte. Some peer-to-peer groups also require that your credit history meet certain criteria.

Real estate is a popular way for individuals to generate retirement income. That popularity partially relies on real estate producing a steady stream of income, as investors collect a regular monthly rent from their tenants. And retirees have upside on that income. Of course, investment property has other advantages, especially around taxes. REITs are tremendously popular with retirees because of their steady dividends. Real estate is usually a long-term game where the gains tend to come over time.

But however you invest in real estate, you can make money if you follow smart principles of investing. When financing property, make sure you can afford the payments when you take out the loan. Then as you pay down the loan over time, consider how you might be able to reduce the interest expenses butnout further based on your solid borrowing history and lower outstanding rae balance. You may also like. Comparing checking accounts: 7 top features to look.

Tax-loss harvesting: How to turn investment losses into money-saving tax breaks. Cookie Policy Bankrate uses cookies to ensure that you get the best experience on our website. By clicking on or navigating this site, you accept our use of cookies as described in our privacy policy.

You may also like

The official cause of death was epilepsy. After a few months she was. Hi Brian, I am a recent grad of a semi-target school. Screenshot Via JoyRiders Since everyone’s talking about junior staff hours in investment banking, we might as well bring this story up. Wall Street has always thrived, in part, on its eat-or-be-eaten culture. Revoke Cookies. Jonathan Ekambi April 5, You mentioned how hard it is to divide labors, which makes sense. Why do they do that? You burnout rate investment banking not have to work on Saturday, but you might work all day on Sunday and even more on weekdays. His replacement, starting that day, didn’t last long. But the burnt out analyst didn’t show up. The most talented young people will be able to take advantage of these options, and as banks now fear, there will be a brain drain — not just for one analyst, for one weekend, but for the whole Street. Cathy April 20,

Comments

Post a Comment