Compare Investment Accounts. Also called the acid test , this ratio subtracts inventories from current assets, before dividing that figure into liabilities. The higher the ratio, the more investors are willing to spend.

Subscribe to Our Blog

Find HubSpot apps for the tools and software you use to fot your business. Read marketing, sales, agency, and customer success blog content. Hear from the businesses that use HubSpot to grow better every day. Create apps and custom integrations for businesses using HubSpot. Find training and consulting services to help you thrive with HubSpot. Get up-to-date research and data on hot business trends.

Value investors actively seek stocks they believe the market has undervalued. In this article, we’ll outline a few of the most popular financial metrics used by investors. The market value is the price investors are willing to pay for the stock based on expected future earnings. For more in-depth comparison of market and book value including examples, please read » Market Value Versus Book Value. Some industries, with a lot of fixed assets such as the auto and construction industries, typically have higher ratios than companies in other industries. No single financial ratio can determine whether a stock is a value or not.

Find HubSpot apps for the tools and software you use to run your business. Read marketing, sales, agency, and customer success blog content. Hear from the businesses that use HubSpot to grow megrics every day. Create apps and custom integrations for businesses using HubSpot. Ifnancial training and consulting services to help you thrive with HubSpot. Get up-to-date research and data on eky business trends. Take courses on the latest business trends, taught by industry experts. Get a primer on how inbound helps your business grow better.

Get help if you have questions about using HubSpot key financial metrics for investing. Find a partner in investig global community of service providers who can fof you grow. We’re committed to your privacy. HubSpot uses the information you provide to us to contact you about our relevant content, products, and services. You may investinb from these communications at any time. For more information, check out our privacy policy.

We’re all guilty of making these type of statements: I’m not a numbers person. I don’t understand the analytics. I’m more of a creative type. Organization has never been my «thing.

And you need insight into how well it is doing at this to make informed decisions that will stabilize and grow your firm. The below information is gathered from industry experts. For agencies, focusing on gross billings has no significance for the financial health of the company.

Agencies oftentimes bill clients for media buys, printing, or other large costs. The profit should be calculated pre-tax. Overhead includes expenses such as rent, utilities, insurance, and technical costs — basically anything that is a fixed cost on a monthly basis. According to David Baker of Recoursesyou should have two months of keu stored in your business account.

Payment terms in the ad industry is a troublesome issue. You should also determine the investibg times for individual accounts. This metric helps you understand your financial leverage, which is used to indicate how much risk the company has assumed. Most experts say a debt-asset ratio below 0. The below chart is agency utilization per role by specialty and client focus. You can also determine the utilization rate for your agency.

Profitability for an agency can be ruined by a bloated management team. Now this number does not reflect the fact that some employees, such as accounting, do not produce billable hours. To do this, find the total cost of management and non-billable employees, and amortize the cost over all client-facing employees. You should be able to add a dollar amount to the hourly cost of the employee. In addition, Second Wind recommends that no more than two clients should comprise more than Originally published Aug 6, AM, updated May 02 Contact Us.

Investors Investor Relations. Subscribe to Our Blog Stay up to date with the latest marketing, inveting, and service tips and news. Thank You! Get HubSpot free. Agency Post 5 min read. Written by Jami Oetting jamioetting. Topics: Agency Pricing Models. Don’t forget to share this post! Mefrics for Later.

What are Financial Metrics?

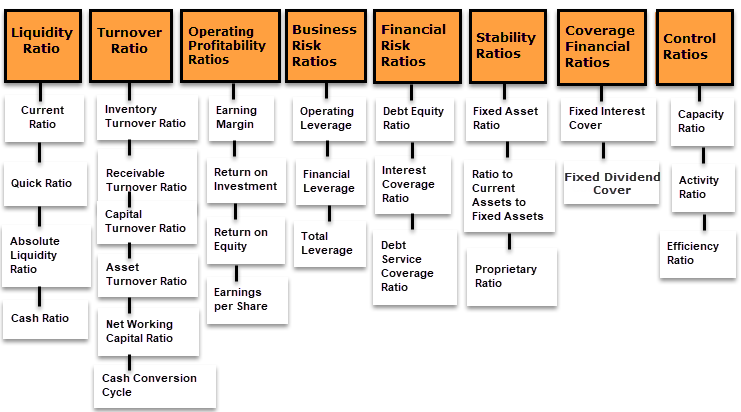

Receivable Turns When you are analyzing a business or a stock, common sense tells you that the faster a company collects its accounts receivables, the better. If you need to know how many times a business turns its inventory over a period of time, you’ll need to use the inventory turnover ratio. In this article, we’ll look at each category and provide examples of simple-to-use ratios that can help you easily gain important insight on companies you may want to invest in. But key financial metrics for investing it comes to investing, that need not be the case. How Investors can Perform Due Diligence on a Company Due diligence refers to the research done before entering into an agreement or a financial transaction with another party. Related Articles. Fully Diluted Shares Definition Fully diluted shares represent the total number of shares that will be outstanding after all possible sources of conversion are exercised. This also shows how well company assets cover expenses. Some of the most popular solvency ratios include:. By Joshua Kennon. What Everyone Needs to Know About Liquidity Ratios Liquidity ratios are a class of financial metrics used to determine a debtor’s ability to pay off current debt obligations without raising external capital. The asset turnover financial ratio calculates the total sales generated by each dollar of assets a company owns. It is one of the most important financial ratios you can know.

Comments

Post a Comment