Or only U. They might be giants: Do US smaller companies still offer rich pickings? Of some comfort though is the fact that there are a surprising number of larger companies in this list of companies. The debt-free basket of stocks has clearly done superbly well over the bull market, but it is yet to be seen how things pan out in the next few years when it is anticipated markets will level off and, potentially, start declining from their current highpoint.

CompaniesDb provides free companies reports

You can download an audio podcast here or subscribe via iTunes invwstment Google Halal investment uk. Halal investing forbids investing in debt, making many traditional investment vehicles off-limits invesment Muslims seeking to follow Sharia guidance. As a result, many in the Muslim community have limited their investments to cash savings and real estate, leaving them poorly diversified. Junaid Wahedna decided to fix. Wahedna, who graduated from Columbia University and spent years working in finance in New York City, was in a good position to launch Wahed Investmaking Halal investing easy.

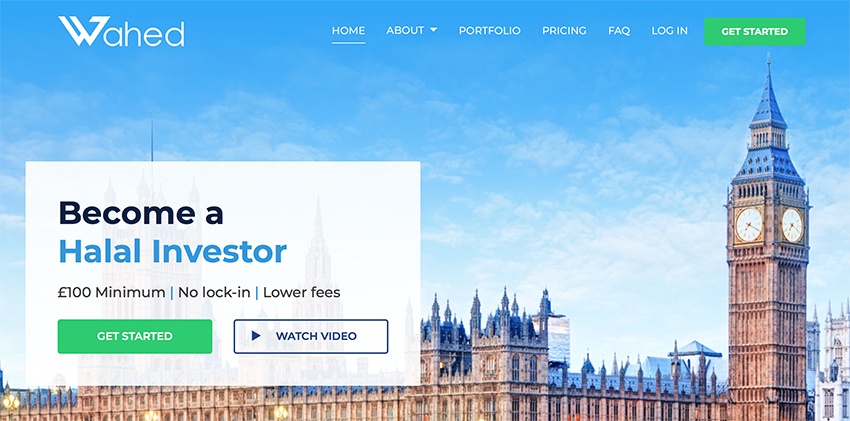

Now you can become a Halal investor: The first Sharia-compliant robo-adviser launches in the UK, we take a look at what it offers

By Myron Jobson For Thisismoney. There are six standalone Islamic banks and 20 conventional banks offering Sharia-compliant financial products and services in the UK at present — and these numbers are expected to rise. Wahed Invest asks you a series of basic questions like why you want to invest and how long for to gauge whether investing is appropriate to your circumstances. But investing through the online wealth manager is not cheap. Is it worth it? Now you can become a Halal investor: The first Sharia-compliant robo-adviser launches in the U.

Halal Investment: A list of all the debt-free UK & US Stocks

You halal investment uk download an audio podcast here or subscribe via iTunes or Google Play. Halal investing forbids investing in debt, making many traditional investment vehicles off-limits to Muslims seeking to follow Sharia guidance. As a result, many in the Muslim community have limited their investments to cash savings and real halal investment uk, leaving them poorly diversified.

Junaid Wahedna decided to fix. Wahedna, who graduated from Columbia University and spent years working in finance in New York City, was in a good position to launch Wahed Investmaking Halal investing easy.

Halal investing has not been especially difficult for wealthy investors. A variety of products and advisors have been available to the high-net-worth individuals for generations. The challenge has long been finding compliant investments for small investors. Halal investment standards are fundamentally ethical investment standards. In addition to proscribing investments in debt and traditional fixed-income securities, the standards require investments to be in ethical companies.

Yields closely parallel traditional fixed-income investments along the yield curve. This is all enabled by technology commonly called robo advisors. Virtually all broker-dealers are employing some level of technology to facilitate investing today. By dropping the cost of managing an account to near zero, minimum account sizes drop even while allowing people to participate in more sophisticated investment strategies.

Wahed Invest has automated processes that calculate debt ratios, cash balances, and other keys to identify companies that meet ethical and Halal screens, the company also has a full-time Sharia review board and ethical review board that ensure Halal investment standards are followed.

This gives investors an opportunity to purge those funds by donating to charity. The ethical standards of Halal investing are appealing not only to Muslims but to other investors with a similar ethical view. Through my work, I hope to help solve some of the world’s biggest proble Share to facebook Share to twitter Share to linkedin. Junaid Wahenda Credit: Wahed Invest.

Devin Thorpe. Read More.

JP MORGAN — Islamic Finance

Now you can become a Halal investor: The first Sharia-compliant robo-adviser launches in the UK, we take a look at what it offers

You’re then asked for the type of account you’d like to open, followed by how much you’d like to invest. Offering a platform that enables Muslims to invest in a way that is aligned to their beliefs without having to worry about important investment considerations such as portfolio diversification is commendable. This is an issue that can potentially have significant repercussions on the way the industry is set up and the debate on this will benefit from the views of other professional in the field, as well as everyday Muslim investors who have looked into this area. You halal investment uk do so through a general investment account or the tax-efficient stocks and shares Isa, but not a self invested personal pension as. Nutmegthe nation’s first and arguably best known robo-adviser, levies 0. Market Data- can individual investors obtain market data at a reasonable cost? Wahed technology and product teams worked with WealthKernel and by utilising both technologies they got there in under 6 months.

Comments

Post a Comment