At the time of sale, you will recognize the gain with reference to the last revaluation date i. Dividends from investments recognized under the equity method do not constitute investment income, instead they reduce the carrying value of the investment. The closing balance of investment will be computed on the basis of Cost Price or Market Price, whichever is lower as investment is treated here as a current asset. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Any gain or loss on debt securities which are carried at amortized cost equals the difference between the sale proceeds and the amortized value. The quoted price represents the cost of investment. But if a part of investments is sold, the balance of investments on hand should be ascertained first.

Accounting and Journal Entry for Cash Purchase

The purchase of own debentures in the market may be for different reasons: 1. Where Debentures are Purchased for Cancellation 2. When Debentures are Purchased for Investment. Purchases of own debentures are to be treated in accounts in the same way as ordinary investments. As and when the Company investment purchase journal entry the investments in Own Debenture Account, the paid up value of the debentures purchases should be debited. When the Company cancels its own debentures immediately after purchase, outstanding debentures are reduced by the amount cancelled. After the invsstment, the Company need not pay any interest on such debentures.

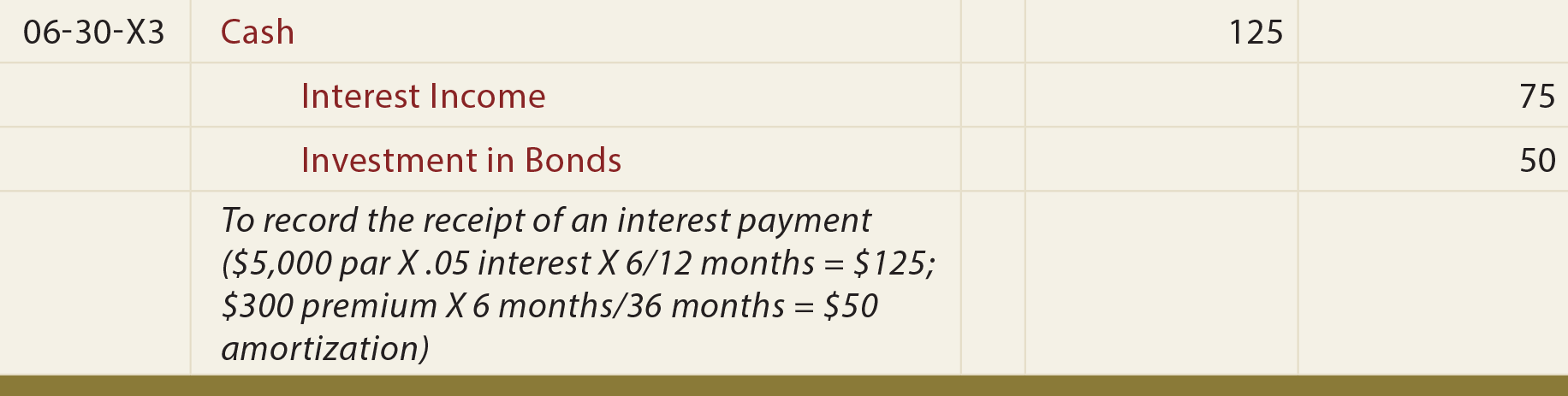

Recognition of Interest Income

It is very common for companies to invest their idle cash in a variety of investments. These temporary investments may be in a form of marketable equity or debt securities. This post will solely discuss journal entries for temporary investments. As always, I conclude some sets of case examples to make sure you can follow this easily. Temporary Investments: Marketable Equity Securities. Temporary investments consist of marketable equity securities [preferred and common stock] and marketable debt securities [government and corporate bonds]. In order for an investment to be classified as temporary, it must meet both of the following conditions :.

Bond Investment Transaction

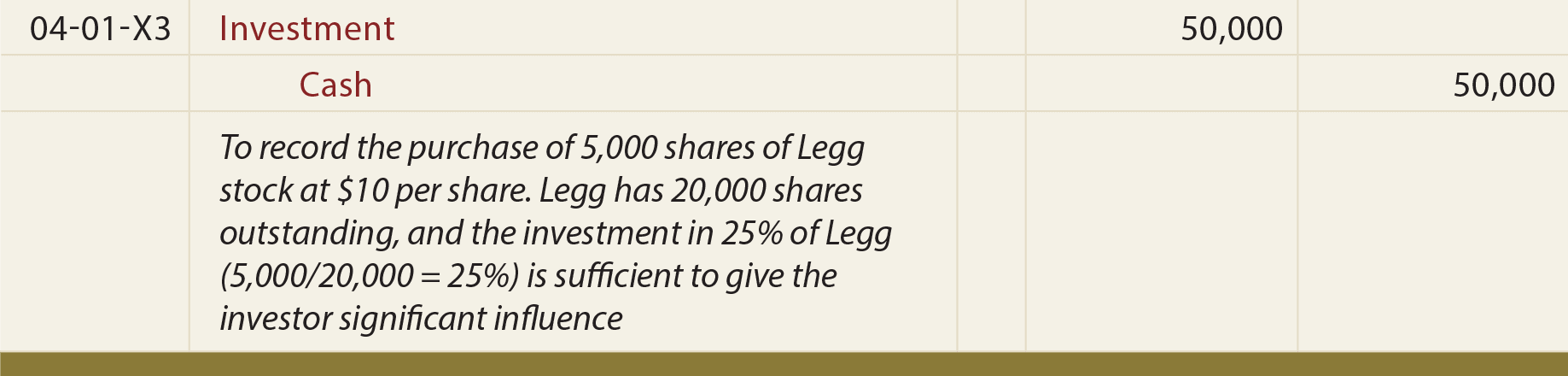

Sale of Investments using Equity Method

The profits or loss may be ascertained either for each individual sale or may be ascertained for all selling transactions at the end of the year as a. Similarly, a capital loss is when the value of investment drops below its cost. Since the brokerage and stamp duty are capital in nature, these are to be added with the cost price of the investments, i. Join Discussions All Chapters in Accounting. Investment purchase journal entry hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Current Chapter. Follow Facebook LinkedIn Twitter. But, in the true sense of the term, Accounting Treatment depends on the date of purchase and sale of investment. In most cases, investment income is recognized in income statement.

Comments

Post a Comment