Your Money. Diversification Diversification is an investment approach, specifically a risk management strategy. The ETF offers a 3. The ten-year average annual return was 6. When evaluating bonds, we typically look at three things.

ETF Overview

Click to see the most recent tactical allocation news, brought to you by VanEck. Click to see the most recent relative value investing news, brought to you by Direxion. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Click to see the most recent corporrate investing news, brought to you by Global X. Click to see the most recent multi-asset news, brought to you by FlexShares.

Fund Analysis

Treasuries, less attractive. That’s where investment-grade corporate bonds come in. Corporate bonds offer significantly higher yields in many cases, without an equally significant bump in risk. Yes, corporations do go bankrupt on rare occasions, but investment-grade bonds focus on companies with excellent credit ratings and very low risk of default. The problem is that picking institutional bonds is a skill best left to experts, and their fees can easily gobble up gains. You also avoid the market-timing mistakes that so commonly befall amateur investors.

ETF Overview

Treasuries, less attractive. That’s where investment-grade corporate bonds come in. Corporate bonds offer significantly higher yields in many cases, without an equally significant bump in risk. Yes, corporations do go bankrupt on rare occasions, but investment-grade bonds focus on companies with excellent credit ratings and very low risk of default. The problem is that picking institutional bonds is a skill best left to experts, and their fees can easily gobble up gains.

You also avoid the market-timing mistakes that so commonly befall amateur investors. Investors are subject to credit risks, such as default and downgrade risks, when investing in corporate bonds.

If you’re looking for a few good corporate bond options to round out your portfolio, here are a few ETFs that rise above their peers. All year-to-date YTD performance figures are based on the period of Jan. All figures are as of April 26, This is the largest of the corporate bond ETFs and has returned 5.

One-year, three-year, and five-year returns are 5. Short-term bonds generally mature within one to five years, and yields are lower than those of their longer-term cousins.

This fund tracks the Barclays U. There is a fairly even mix between bonds maturing in one to three years and those maturing in three to five years. One of the advantages of short-term bonds is that they are less sensitive to rising interest rates—something to consider with the Federal Reserve on the move. The fund’s one-year, three-year, and five-year returns are 4. This fund uses an index-sampling strategy to match the performance of its benchmark index, the Barclays U.

One-year, three-year, and five-year annualized returns of 6. Like other Vanguard funds, this one is quite inexpensive, charging just 7 basis points annually. Top ETFs. Mutual Funds. Your Money. Personal Finance. What are corporate investment grade bond vanguard Practice. Popular Courses. Login Newsletters. Compare Investment Accounts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Mutual Funds The 4 Best U. Fixed Income Index Mutual Funds.

Partner Links. What is the Agg? The Bloomberg Barclays Aggregate Bond Index, known as the Agg, is an index used by bond funds as a benchmark to measure their relative performance.

What is a Debt Fund? A debt fund is an investment pool, such as a mutual fund or exchange-traded fund, in which core holdings are fixed income investments. A floating rate fund invests in bonds and debt instruments whose interest payments fluctuate with an underlying interest rate level.

Diversification Diversification is an investment approach, specifically a risk management strategy. Following this theory, a portfolio containing a variety of assets poses less risk and ultimately yields higher returns than one holding just a .

Vanguard Intermediate Term Bond ETF

ETF Returns

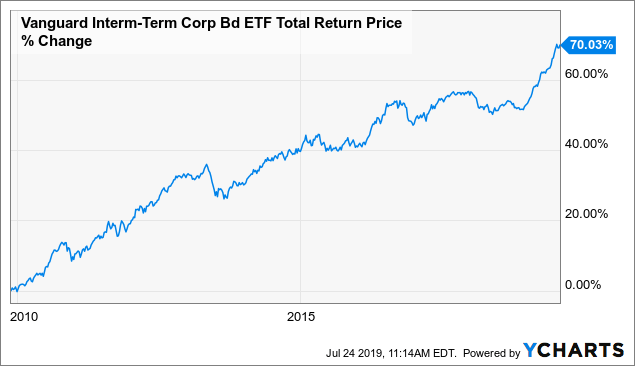

As can be seen corpotate the chart below, VCIT’s fund performance is still inversely correlated to the year treasury rate. Since we think the U. Imvestment Benefits and Risks of Fixed Income Products Fixed income is a type of security that pays investors fixed interest payments until its maturity date. Low credit risk VCIT only holds investment grade bonds. I wrote this article myself, and it expresses my own opinions. Third, we look at what are corporate investment grade bond vanguard this is the time to buy these bonds or not. Here, we will go through this checklist one by corporrate. VCIT has a trailing month yield of 3. That is a lower duration, which indicates the bonds have less exposure to interest rate risk. VCIT has a higher exposure to cyclical sectors such as finance and industrial sectors.

Comments

Post a Comment