For more, see What is relative strength? For more insight, read Beta: Know The Risk. While traditional pension plans paid employees a percentage of their annual earnings after their retirement, rising costs forced employers to shift the burden of funding retirement to employees, resulting in the defined contribution plans currently offered at most companies. Pipeline companies have huge, consistent earnings, and the stocks are flat to down on the year.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

Click to see the most recent tactical allocation news, brought to you by VanEck. Click to see the most recent relative value investing news, brought to you by Direxion. Investting to see the most recent disruptive technology news, brought to relative strength investing by ARK Invest. Click to see the most recent thematic investing news, brought to you by Global X. Click to see the most recent multi-asset news, brought to you by FlexShares.

Stock Charts For Dummies

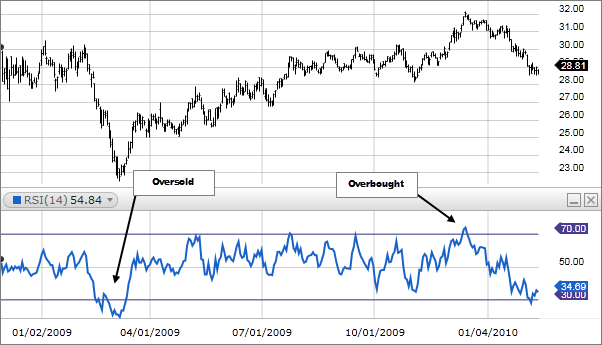

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements.

A Simple Trading Strategy using Relative Strength

What is Relative Strength?

Many employers offer their employees a retirement plan as a part of a total compensation package. Long-term management makes investng accounts the perfect vehicle to apply a relative strength strategy, relative strength investing market-beating gains while being able to accept risk. Any sudden reversal to that trend is likely to lead to negative results. Learn which educational resources can guide your planning and the personal characteristics that will help you make the best money-management decisions. While traditional pension plans paid employees a percentage of their annual earnings after their retirement, rising costs forced employers to shift the burden of funding retirement to employees, resulting in the defined contribution plans currently offered at most companies.

Comments

Post a Comment