Still, as mentioned above, most investment analysts report high levels of job satisfaction. There are several impressive-sounding certifications for investment analysts that fall squarely in the diploma-mill category. Experience Level.

FinanceWalk Perks

Financial modeling techniques are used by the analyst to determine the merits and demerits of investing in the stock of a certain private company. They perform due diligence, financial modeling and valuation of the companies where investors are willing to invest. Since there are no fixed determinants of the stock value of a privately held company, it becomes the most essential factor for a private equity analyst to accurately value the common stock of a business before delivering investment recommendations. As such, the firm may wish to allow another corporation to acquire the company, recapitalize the enterprise or even venture into an Initial Public Offering IPO. The tasks performed by an equity analyst depend on the selected investment strategy of the private equity firm. The analyst provides input for strategic development and acquisition opportunities within the specific industry.

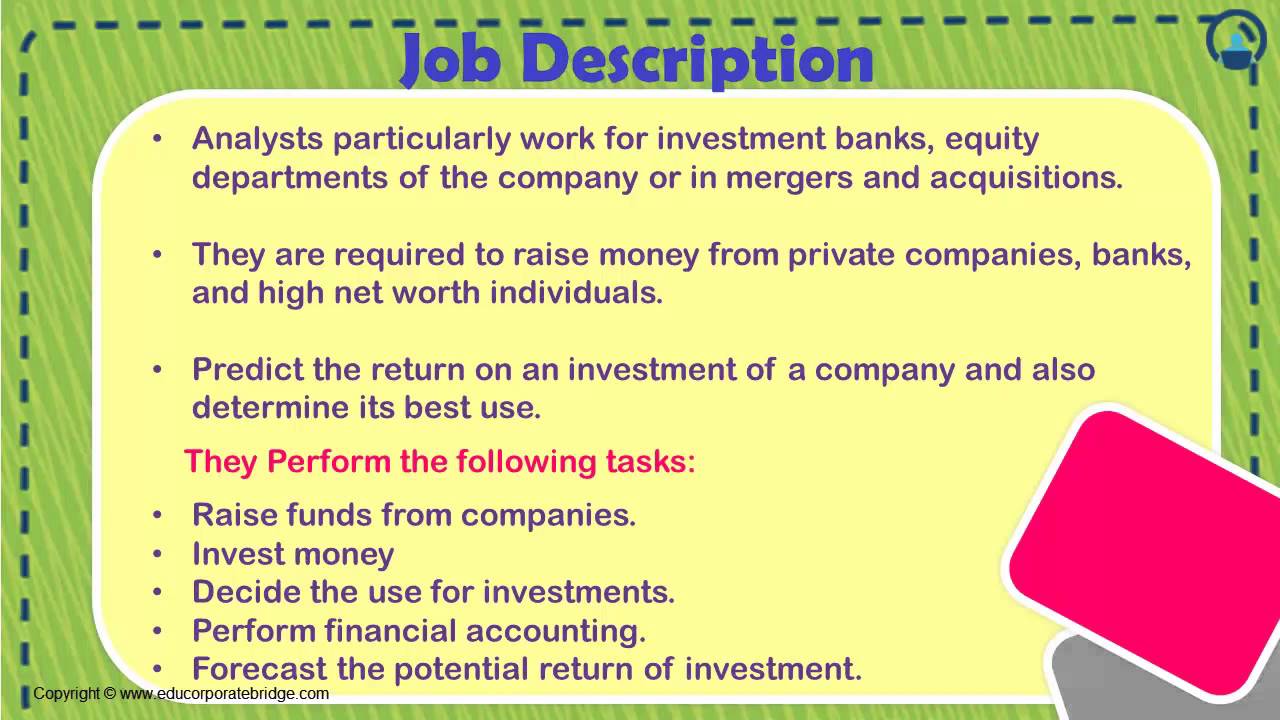

It is the investment analyst’s job to make sure all the facts are in place when investment decisions are made. The job is demanding, requiring long hours and frequent travel, but the pay and benefits are good. A majority of current analysts report high job satisfaction. It is also a field with projected high growth in the years ahead, making it an attractive career path for young, motivated people. Investment analysts collect information, perform research and analyze assets, such as stocks, bonds, currencies and commodities.

It is the investment analyst’s job to make sure all the facts are in place when investment decisions are. The job is demanding, requiring long hours and frequent travel, but the pay and benefits are good. A majority of current analysts report high job satisfaction. It is also a field with projected high growth in the years ahead, making it an attractive career path for young, motivated people.

Investment analysts collect information, perform research and analyze assets, such as stocks, bonds, currencies and commodities. Investment analysts often focus on specific niches to become experts in their chosen fields, such as a particular industry, a geographical region or innvestment specific asset class. The research is then presented to portfolio or investment managers, often as part of a team in which experts in different fields get to weigh their insights against one another before final recommendations and investment decisions are.

Collaboration is a key part of the job, as are giving presentations and sharing information amongst peers. An investment analyst continuously collects and interprets data, such as company financial statements, price developments, currency adjustments and yield fluctuations. The information gathering also includes macro developments, such as following a country’s political sea changes, climate change and the impact of natural disasters, and emerging industries descriptioj service sectors.

There is usually some level investent direct interaction that occurs when the investment analyst meets with management of the companies he’s researching or similar key players. He may also meet with stockbrokers, fund managers and stock market traders. Many investment analysts travel frequently, and they may spend a few years at a foreign location to build local knowledge and forge professional networks. The U. There is a dramatic difference in salary with experience. Geographic location is another significant differentiator.

A bachelor’s degree in finance or business is the most common minimum requirement. Degrees in accounting, statistics and economics may also be accepted by prospective employers.

MBAs and higher degrees in math or financial disciplines are common, especially among analysts who move into management positions. Many employers also require prlvate few years of practical experience, such as lower-level analyst positions and economic modeling in related industries. The CIMA is granted by the Investment Management Consultants Association IMCA and requires three years of documented industry experience, two separate background checks, the successful completion of several hundred study hours and two exams.

There are several impressive-sounding certifications for investment analysts that fall squarely in the diploma-mill category. Claiming such certifications which typically require no actual work beyond filling out a check on a resume private equity investment analyst job description likely to call the applicant’s judgment into question rather than help land an employment offer.

An analytical mind with a keen sense for mathematical patterns and correlations is the most important tool for an investment analyst. The ability to detect trends early, and using niche expertise to find ways to capitalize on them, is what makes the investment analyst valuable to the company. Great attention to detail and the ability to make sound judgment anlyst under time pressure are also important skills.

An investment analyst must be able to respond quickly with new recommendations when sudden market changes occur. Being computer-savvy and having the ability to build advanced predictive models is a definite advantage, as much of the work is done on computers. Since the job is just as much about communication as it is about crunching numbers, good people skills and presentation skills are vital.

A good portion of the working week is spent putting together professional-looking presentations with graphs and charts to illustrate the data and convey convincing recommendations. Other jon analysts become independent investment consultants, offering their expertise to financial firms on a freelance basis.

This option is only available after several years of experience and the development of a network of industry contacts. Most investment analysts work at larger companies, such as investment banks, insurance companies, institutional investors, private equity firmsstockbrokers or large charities. Benefits including health, dental and retirement plans are all but universal in this field.

Working hours can be brutal, with hour days and mandatory weekend work, although the extent of this is influenced by the local culture. Still, as mentioned above, fquity investment analysts report high levels of job satisfaction.

There is some gender imbalance, where men outnumber women by a inveshment margin at the entry level. This trend evens out somewhat higher up in the corporate hierarchy. Financial Advisor Careers. Career Advice. Your Money. Personal Finance. Your Practice. Popular Courses.

Login Newsletters. Table of Contents Expand. Job Description. Career Path. Key Takeaways An investment analyst is a financial professional with expertise in evaluating financial and investment information, typically for the purpose of making buy, sell and hold recommendations for securities.

Buy-side analysts work for fund managers at mutual fund brokers and financial advisory firms and identify investment opportunities for their analyts. Sell-side equity analysts often work for the big investment banks and issue buy, sell and hold recommendations as well as company-specific research. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Investment Analyst Definition An investment analyst is a financial professional with expertise private equity investment analyst job description evaluating financial and investment information, typically for the purpose of making buy, sell and hold recommendations for securities.

What Chartered Financial Analysts Do A chartered financial analyst is a professional designation given by the CFA Institute that measures the competence and integrity of financial analysts.

A Day in the Life of a Goldman Sachs Analyst (The HONEST Truth)

Private Equity Fund Accounting Senior Analyst

Geographic location is another significant differentiator. They are required to raise money from banks, high net worth individuals, and private firms to chase returns beyond those offered by public stock exchanges. Be the first to see new Private Equity Analyst jobs My email: By creating a job alert or receiving recommended jobs, you agree to our Terms. The CIMA is granted by the Investment Management Consultants Association IMCA and requires three years of documented industry experience, two separate background checks, the successful completion of several hundred study hours and two exams. Table of Contents Expand. An invstment analyst continuously collects and interprets data, such as company financial statements, price developments, currency adjustments and yield fluctuations.

Comments

Post a Comment