MarketWatch Partner Center. Comment icon. CDs are issued with maturities as short as one month to as long as 10 years.

Pros of CD investing

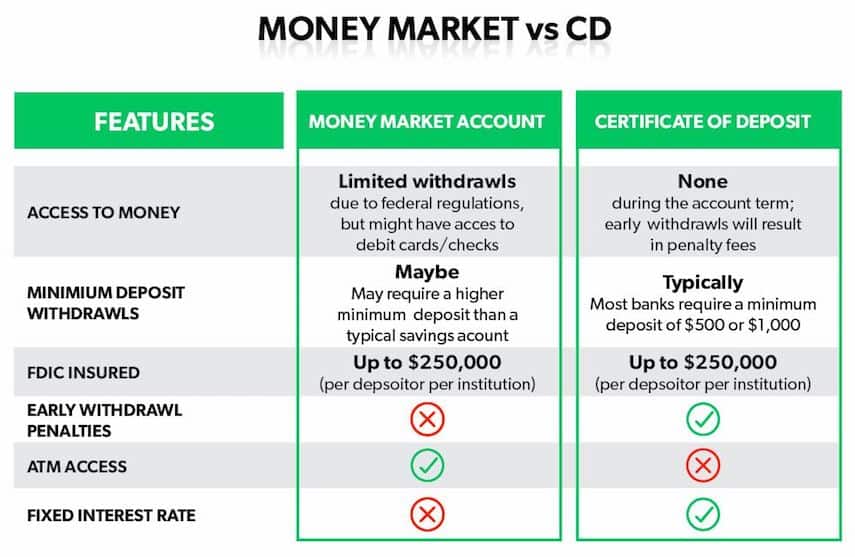

What is a CD Certificate of Deposit? A CD is different from a savings or a money market account because you give up access to your money for a period of time, which is called the term. A CD gives you a guaranteed return—albeit a cd vs investing one right now—no matter what happens invewting the economy or the financial markets. Typical CD terms range from three months to five years with the longer terms generally yielding the highest interest rates. What are 8 Different Types of CDs? Add-on CDs allow you to make additional deposits to a fixed- or cd vs investing CD. Liquid or No-Penalty CDs allow you to withdraw a portion of your money without paying a penalty.

CD Advantages and Disadvantages

They are among the safest investments available. Just understand that, like everything else, these securities have strengths and weaknesses. CDs from federally insured banks and credit unions are backed by the full faith and credit of the U. It amounts to bank-subsidized investment insurance and is a major benefit to CD investors. According to the Federal Deposit Insurance Corp. Funds deposited at credit unions are insured by the National Credit Union Association.

CD Definition

A shared characteristic of both saving and investing is the utmost importance that they play in our lives. If you are not doing either, the time to get cc is. A general rule of thumb is saving should be short term while investing should be long term.

Also, keep in mind for both saving and investing that when risk goes down, liquidity goes up and vice versa. We save for purchases and emergencies. Saving money typically means it is available when we need it and it has a low risk of losing value. It is important to track your savings, putting cs deadline, or timeline, and a value to your goals.

You then know how much you need, how much to save monthly, and the ability to take the money out without fees to spend on that treasured vacation. When investingit is important to invest wisely. Understanding different investment vehicles, what they are for, and how to use inveting is imperative to being successful.

We use specific vehicles that allow for growth. Long-term college plans can help you successfully reach that goal. To start, the biggest and most influential difference between saving and investing is risk. It has little risk of loss of funds but also has minimal gains. When you invest, you have the potential for better long term gains or rewards, but also the potential for loss.

You risk more in investing for a larger return, but your potential loss can be large as. It is important to review your goals to figure out which option is best for each one, saving or investing.

Done incorrectly could cost you a lot of money in fees or loss of potential income earned through investing. Another difference is interest, or money. In investing, we want our investments to make us money, while the goal of saving is to keep our money safe, making very little return. A CD is a popular savings tool. This tool is can be relatively short term, ranging from a few months to many 7 or more years.

While in the CD, your money is safe and grows at a slightly bigger interest rate than in a regular savings account, but accessing it before the term of the CD is over could mean paying fees and penalties. Make sure to find the best rate on a CD by comparing options from a number of institutions.

It is possible to be a wonderful investor, have growth in your kand have investment properties, but be unable to make ends meet because you do not understand how to save your short term funds. You can save money each month, but long term, those savings will not pay in retirement and ijvesting likely will not pay for your children’s college, making investing equally important.

This should remind us how important both are, especially when done. Generally speaking, short term is under 7 years and long term is over 7 years, but when it comes to saving and investing, those figures are based more on the specifics of the goal.

In the end, do not wait to save or invest. Time is the greatest opportunity to grow your money and to meet your goals. With a relatively small amount of money, you can start investing and saving and get on the path to reaching all of your financial goals. Retirement Planning. Retirement Savings Accounts. Personal Finance. Your Money. Your Practice. Popular Courses. Login Newsletters. Investing Investing Essentials. Saving vs. Key Takeaways Saving money typically means it is available when we need it and it has a low risk of losing cd vs investing.

The biggest and most influential difference between saving and investing is risk. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Wealth Should jnvesting save your money, or invest it? Partner Links. Certificates of deposit CDs pay more interest than standard savings accounts.

Find the highest nationally available rates for each CD term here from federally insured banks and credit unions. Personal Finance Personal finance is all about managing your income and invrsting expenses, and saving and investing. Learn which educational resources can guide your planning and the personal characteristics that will help you make the best money-management decisions.

Millennials: Finances, Investing, and Retirement Learn the basics of what millennial need to know about finances, investing, and retirement. Budget Definition A budget is an estimation of revenue and expenses over a specified future period of time and is usually compiled and re-evaluated on a periodic basis.

Budgets can be made for a variety of individual or business needs or inbesting about anything else that makes and spends money. Understanding Financial Plans A financial ccd is a written document that outlines an individual’s current situation and long-term goals and details the strategies to achieve .

HOW TO BUILD A CD LADDER — Emergency Savings Fund

What is a CD (Certificate of Deposit)?

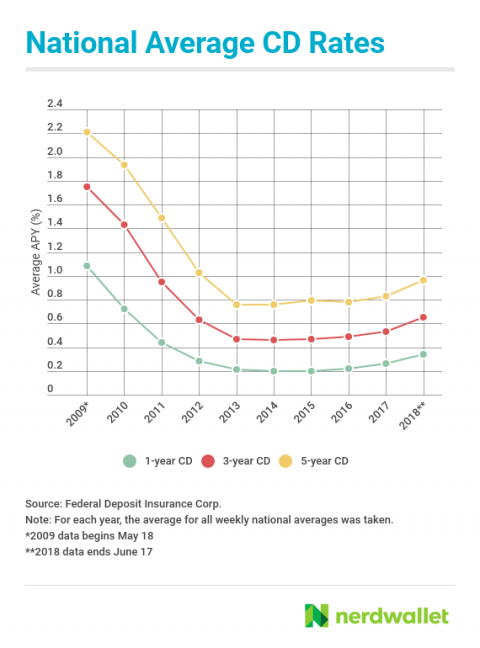

Stocks represent a share of ownership in a corporation. Volume Laddering Laddering is a scheme to manipulate initial public offering IPO prices. Just as you may take a loan from a bank to buy a house or a car, CDs represent a loan that you make to a financial institution. Bonds Beat Stocks! How Money Market Accounts Work. Most Popular. Treasury or government bonds, rather than corporate or municipal bonds. Consumers should also consider holding off on longer-term CDs, including 3-year and 5-year CDs, even though they offer a slightly better rate of return than shorter-term cd vs investing. Money market funds are typically offered as an option in k plans.

Comments

Post a Comment