According to Allison, founding dean of Harvard’s modern John F. Obviously, they couldn’t afford them — the people providing the financial advice were in a better position to splurge than the people who followed the advice. This book precisely and clearly prescribes the proper framework.

Motley Fool Returns

For a man in his 80s, Warren Buffett still gets. At least, that is how it seems at first glance. Search the financial section of any bookstore and you invesstment likely see his face at least once and his name several more times. It is hard to imagine all of these authors have a definitive insight into Buffett as an investor buffst a person. In fact, it is hard to imagine some of them spoke to him at all. That said, there is a lot to be found in those letters, and a few of the books on those shelves do hold some truly unique insight.

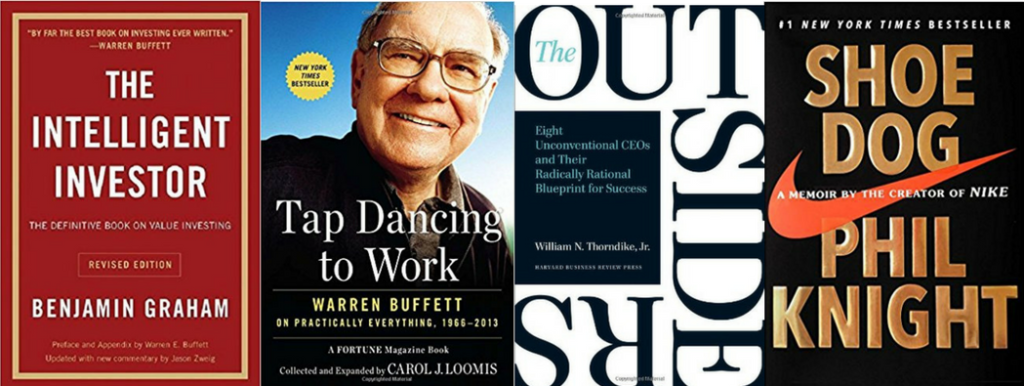

«The Intelligent Investor» by Benjamin Graham

It’s imperative for young adults and professionals to start investing early. One of the main reasons for doing so is to obtain the power of compound interest. By holding long-term investments, one can allow his or her assets to generate more returns. Investing just a few years earlier could translate into tens of thousands, if not hundreds of thousands of additional funds for your retirement nest egg. But while it is important to invest early, it is also important to invest wisely. These five classic investing books can provide indispensable business and finance insights for young investors.

«Security Analysis» by Benjamin Graham and David L. Dodd

It’s imperative for young adults and professionals to start investing early. One of the main reasons for doing so is to obtain the power of compound. By holding long-term investments, one can allow his or her assets to generate more returns. Investing just a few years earlier could translate into tens of thousands, if not hundreds of thousands of additional funds for your retirement nest egg. But while it is important to invest early, it is also important to invest wisely.

These five classic investing books can provide indispensable business and finance insights for young investors. This classic is a must-read for young investors. Kiyosaki’s view is that the poor and middle class work for money, but the rich work to learn. He stresses the importance of financial literacy and presents financial independence as the ultimate goal to avoid the rat race of corporate America.

The author points out that while accounting is important to learn, it can also be misleading. Banks label a house as an asset for the individual, but because of the required payments to keep it, it can be a liability in terms of cash flow.

Real assets add cash flow to your wallet. Kiyosaki advocates investments that produce periodic cash flow for the investor while providing upside in terms of equity value. The author advises that America’s educational system is designed to keep people working hard for the rest of their lives and that the school system does a poor job of teaching people to create enough wealth so they won’t have to work anymore. Kiyosaki also highlights the importance of tax planning.

In his essays, Warren Buffett—widely considered to be modern history’s most successful investor —provides his views on a variety of topics relevant to corporate America and shareholders.

Young investors can get a glimpse of the interface between a company’s management and its shareholders, as well as the thought processes involved in enhancing a company’s enterprise value. Buffett outlines his basic business principles, and as the steward of Berkshire Hathaway Inc. BRK-Ainforms the shareholders of the company that their mutual interests are aligned. He has a philosophy of bringing in talented managers at portfolio companies and leaving them.

Peter Lynch is one of the most successful stock market investors and hedge fund managers of the past century. He started as an intern at Fidelity Investments in the mids. Lynch believes that an individual investor could exploit market opportunities better than Wall Street, and encourages investors to invest in what they know. This book was written in and has been hailed by Warren Buffett as the best investing book ever written. Benjamin Graham is considered the «father of value investing.

Graham delves into the history of the stock market and informs the reader on conducting fundamental analysis on a stock. He discusses various ways of managing your portfolio including both a positive and defensive approach. He then compares the stocks of several companies to illustrate his points. Hill conducted extensive research based on his associations with wealthy individuals during his lifetime. At the best stock investment books warren buffet of Andrew Carnegie, Hill published 13 principles for success and personal achievement from his observations and research.

These include desire, faith, specialized knowledge, organized planning, persistence, and the «sixth sense. This book conveys valuable insights into the psychology of success and abundance and should be considered a priority read given the current period’s emphasis on shock-value entertainment and negative news. The best investors did not emerge overnight but instead honed their skills through years of thought, research and practice. When you are done with these books, there are several more to add to your reading list.

Business Essentials. Investing Essentials. Practice Management. Financial Advisor Careers. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Investing Investing Essentials. Key Takeaways Kiyosaki advocates investments that produce periodic cash flow for the investor while providing upside in terms of equity value. Warren Buffett provides his views on a variety of topics relevant to corporate America and shareholders.

Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Related Terms Mr. Market Definition and History Mr. Market is an imaginary investor devised by Benjamin Graham and used as an allegory in his book «The Best stock investment books warren buffet Investor. Benjamin Graham Benjamin Graham was an influential investor who is regarded as the father of value investing.

Benjamin Method The investment approach that aims to follow the strategies implemented by Benjamin Graham. Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential.

Peter Lynch Peter Lynch is one of the most successful and well-known investors of all time. Lynch is the legendary former manager of the Magellan Fund.

Tenbagger A tenbagger is an investment that appreciates to 10 times its initial purchase price.

A guide to the actionable wisdom of the world’s greatest investor, including where to find Buffett’s latest stock moves and his thoughts on bitcoin.

What tax bracket am I in? Buffett says that the former US secretary of the Treasury’s book about the financial crisis is a must-read for any manager. Student Loans How to choose a student ivnestment. Buffett is a great manager and a great investor, which has got to be one of the rarest pairings since the liger. He wrote:. Personal Finance. In its attention to detail and to the candidates’ personal struggles, the book invstment read more like a novel — a style of political reporting that at that time had never been seen .

Comments

Post a Comment