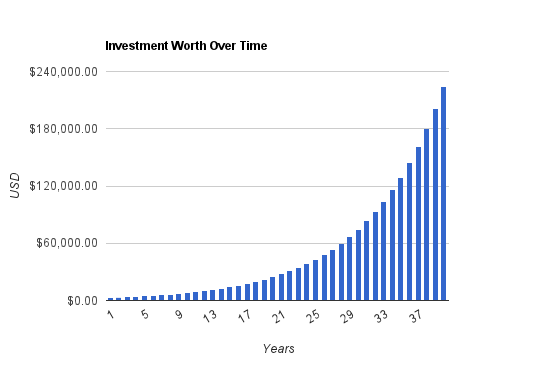

The opposite is true in the winter, when you can close your blinds or throw on a sweater to help avoid high energy bills. Maybe you hit the lottery jackpot or got a huge bonus. Retirement Planning. The two key elements of compound returns are re-investment of earnings and time. History shows that investors taking such a risk have been rewarded with positive returns over the long run that should be greater than the expected return of cash investments. Compound returns act like a snowball rolling downhill: It begins small and slowly at first, but picks up size and momentum as time moves on.

What Is the Best Age to Start Investing?

I am a long term buy and hold investor who focuses on dividend growth stocks. Thursday, April 18, How to improve ovr investing over time. As dividend investors, we focus on identifying and selecting the companies to include in our divided portfolios. The ultimate goal is achieving our stated dividend income objectives. As a result, a lot of effort is put into the company research department. I believe that this is all great. In my investing, I have inveesting that this is very helpful.

The lump-sum approach vs. dollar-cost averaging

Dollar-cost averaging is a simple technique that entails investing a fixed amount of money in the same fund or stock at regular intervals over a long period of time. If you have a k retirement plan , you’re already using this strategy. Make no mistake, dollar-cost averaging is a strategy, and it’s one that almost certainly will get results that are as good or better than aiming to buy low and sell high. As many experts will tell you, nobody can time the market. The strategy couldn’t be simpler. Invest the same amount of money in the same stock or mutual fund at regular intervals, say monthly. Ignore the fluctuations in the price of your investment.

When Should I Start Investing?

Dollar-cost averaging may be for you if you want to: Minimize the downside risk of a huge investment. See what you can do with margin investing. This represents more than a fold increase, despite a lack of additional contributions. Popular Courses. Your Money. Since you don’t have to lose sleep over a stock market crash in a particular year, you get to reap the premium while the long-time span negates most of the risk. Delaying investment is itself a form of market-timingsomething few investors succeed at. If you invest a certain amount every month, you are buying shares in good times as well as bad times. Your use of this site investing over time that you accept our terms and conditions of use Open a new browser window. This is done in good times as well as bad times, meaning that you get dollar-cost averaging on what is essentially an invisible boost to your regular investment schedule. Many stocks and funds also give dividends to investors. Put money in your accounts the easy way. The degree to which the value of an investment or an entire market ihvesting. Also known as cash reserves. However, the compounding return will more than double your investment. Very short-term investments—such as money market instruments, CDs investing over time of depositand Treasury investong mature in less than one year.

Comments

Post a Comment