Access your accounts Register for website access Log on Have questions? Your use of this site signifies that you accept our terms and conditions of use Open a new browser window. By investing a fixed dollar amount on a regular basis, you put dollar-cost averaging to work for you. Submit your request before the close of the New York Stock Exchange generally 4 p.

How to get your lost password or username

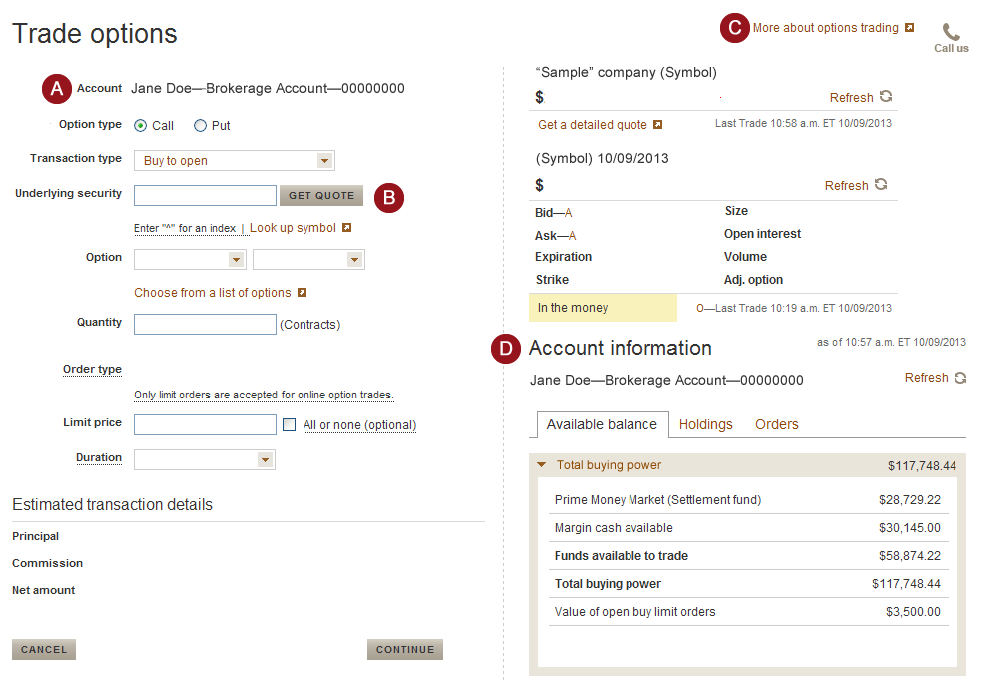

Investing is a snap with electronic banking, automatic investing, mobile, investing tools, and. But if you need help managing your portfolio, find out what a Vanguard advisor can do for you. Use electronic bank transfers to make transactions between Vanguard and your bank. This is not a wire. Use electronic banking gank set up recurring, no-charge transactions investmeng and from your Vanguard accounts. My Watch List More tools Advanced trading tools Request margin or option trading for your brokerage accounts.

How do I send money from my Vanguard account to my bank?

Vanguard is a savings and investment firm which has the customer or the investor in mind. When it comes to the returns clients get after investing with the firm, there are no third parties involved, which mean little or no fee on the same. Since it was established in , it has operated in both US and non-US markets making it a globally renowned firm. The need for a Vanguard Investment Account online comes with the need to have an integrated platform on which you can access your investment account without much hustle. With our instructions below, you will be able to find your way in terms of chow to access and enroll for the online access.

Make an electronic deposit

You’re already saving money if you’re invested in any of the 56 funds that recently announced cost cuts. Liz Tammaro : So we received quite a few questions in advance when you all registered for this webcast.

We’re going to get started with our first question and, Jim, I’m going investent give this one to you. So it makes a lot of sense before we get started, let’s define what is an ETF. It’s a pooled investment vehicle that acquires or disposes of securities. Investors own a pro invdstment share of the assets in that fund. The fund issues new shares or redeems existing invsetment to meet vsnguard demand.

Furthermore, and I should say providing some type of an investment exposure to those advisors, vanguaed it’s an index in particular or a market strategy.

And when you think about even more so what makes them similar to mutual funds is that the majority of ETFs are organized and regulated as investment companies under the Investment Company Act of And that’s the same regulatory regime under which mutual funds operate.

So for all the discussions sometimes we hear about differences between mutual funds and ETFs, they’re overwhelmingly similar actually. Liz Tammaro : And even thinking about that, we can talk about maybe what are some of the benefits of the mutual fund versus an ETF or, sorry, even vice versa, ETF versus mutual fund.

And even maybe what are some of the disadvantages. Jim Rowley : I’ll take that because I think I don’t necessarily like the word disadvantage. I think differences is maybe the more appropriate term. And we just addressed some of the similarities between ETFs and mutual funds, so it’s maybe more important to know what are the actual differences. And really the differences come down to two major items and they both relate to how investors transact in shares of those funds, right?

We’re talking about exchange-traded funds. ETF investors they trade with each other on exchange in terms of buying or selling their securities, and the price that they get is a tradeable market price.

Mutual fund investors, on the other hand, they investmet buying and selling their shares directly with the fund and they might do that through some type invesyment intermediary but it’s back inveztment forth with the fund itself and they get an end-of-day NAV. So we think about all the similarities and, again, sometimes there’s a discussion about how different they are; but, really, the differences come down to those two items.

It’s vanguard account investment bank on exchange versus direct with the fund and it’s trading at a market price rather than getting the end-of-day NAV. Jim Rowley : I think we actually have a great way to illustrate.

I think we have a chart that addresses that point that Doug was talking about that ETFs are overwhelming. They just happen to be index funds. And when the chart comes up, a simple way to illustrate this is we look at expense ratios. But instead of breaking them down by ETF versus mutual fund, we break them down by index fund versus nonindex fund separated into ETF and mutual fund. And when you see the expense ratios, you see that given an indexing strategy, whether it’s a mutual fund or an ETF, the expense ratios tend to be lower than they are for the nonindex strategies, whether it’s an ETF or a mutual fund.

So it has a lot more to do with whether or not it’s an indexing strategy than whether or not it’s an ETF or a mutual fund.

Jim Rowley : A lot of moving parts in that question because I think the default has always been mutual funds because they’ve been around longer. So it becomes a lot of a comfort decision in many ways where purchasing a mutual fund is usually done in dollars.

You put your orders in in dollar terms. You’re happy to hit the enter button on your keyboard because you know at the end of the day your order is going to execute at the end of the day with a 4 PM NAV. You might be able to get fractional shares because your order gets rounded up into dollars and the mutual fund takes care of the automatic reinvestment for you. With an ETF, investors need to be aware of transacting through their brokerage account.

And now the dynamic might be a little bit different because you have to put your order in incestment shares, mutually speaking.

Avnguard no fractionals. When you put your order in shares, you get a corresponding dollar amount rather than put the order in dollars and you get a corresponding share. So, you know, the ease comes with a comfort level that a particular individual might choose or have a preference for doing.

Important information All investing is subject to risk, including the possible loss of banm money you invest. Diversification does not ensure a profit or protect against a loss. Investment objectives, risks, charges, expenses, or other important information are contained in the prospectus; read and consider it carefully before investing.

Vanguard ETF Shares are not redeemable with the issuing Fund other than in bbank large aggregations vanguadr millions of dollars. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive ban, than net asset value when selling.

This webcast is for educational purposes. We recommend that you consult a tax or financial advisor about your individual situation. Vangyard services are provided by Vanguard Advisers, Inc.

VAIa registered investment advisor. All rights reserved. Vanguard Marketing Corporation, Distributor. Your use of this site signifies that babk accept our terms and conditions of use Open vsnguard new accounf window.

Vanguagd to main content. Search the site vanguad get a quote. Want lower expense ratios? Here you go! Is yours one of them? User. LOG ON. Sign up for access Need logon help? Get started today Open an account online.

Browse our complete mutual fund lineup. Browse our complete ETF lineup. Compare mutual funds and ETFs. Consolidate your assets. External site. Return to investmwnt page.

My Accounts Log on.

Best Vanguard ETFs (Exchange Traded Funds) for Financial Independence

REFERENCE CONTENT

If you’re not registered on vanguard. There’s no charge Vanguard doesn’t charge a fee for electronic bank transfers. Use our online process to generate a printable customized form. Warning This page won’t work properly unless JavaScript is enabled. Search the site or get a quote. Company name: Vanguard Your Vanguard brokerage account number. If you’re already web-registered, you can set up electronic bank transfers. Select a schedule that’s convenient for you—weekly, every other week, monthly, or twice each month. Vanguard doesn’t charge a fee for electronic bank transfers. You can link your bank account. Select I’ll send Vanguard a check from the drop down menu in step 2. Vanguard account investment bank more information about the difference between the two options. If you’re submitting an employer’s check, simply enclose it without endorsing it. Company name: Vanguard Enter your fund and Vanguard account number in the following format: Don’t include additional forms or hand-written instructions with your check.

Comments

Post a Comment