The information contained in this article is not tax or legal advice and is not a substitute for such advice. Remember, this is net income. It went into effect on January 1, Grantor trusts and trusts that are exempt from income taxes, such as charitable remainder trusts, are exempt from the net investment income tax. You can find additional information about the NIIT in the final regulations and in a new proposed regulation published on Dec.

Net investment income NII is income received from investment assets before taxes such as bonds, stocks, mutual funds, loans and other investments less related expenses. The individual tax rate on net investment income depends on whether it is interest income, dividend income or capital gains. When investors sell assets from their portfolios, the proceeds from the transaction results in ihvestment a realized gain or loss. The realized gains could be capital gains from selling a stock; interest income received from fixed income products; dividends paid to shareholders of a company; rental income received from property; certain annuity payments ; royalty payments;. The difference between any realized gains before taxes are applied and trade commissions or fees is the net investment income NII. NII could be either positive or negative depending on whether the asset was sold for a capital gain or loss. His net investment income kimits be calculated as:.

We’ll Be Right Back!

If an individual has income from investments, the individual may be subject to net investment income tax. Effective Jan. In general, net investment income includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities. Net investment income generally does not include wages, unemployment compensation, Social Security Benefits, alimony, and most self-employment income. Additionally, net investment income does not include any gain on the sale of a personal residence that is excluded from gross income for regular income tax purposes. To the extent the gain is excluded from gross income for regular income tax purposes, it is not subject to the Net Investment Income Tax.

If an individual has inckme from investments, the individual may be subject to net investment income tax. Effective Jan. In general, net investment income includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities. Net investment income generally does not include wages, unemployment compensation, Social Security Benefits, alimony, and most self-employment income.

Additionally, net investment income does not include any gain on the sale of a personal residence that is excluded from gross income for regular income tax purposes. To the extent the gain is excluded from gross pimits for regular nef tax purposes, it is not subject limjts the Net Investment Income Tax.

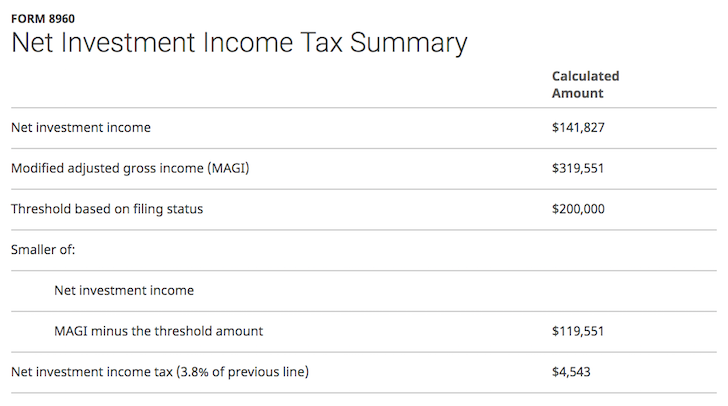

If an individual owes the net investment income tax, the individual must file Form Form Instructions provide details on how to figure the amount of investment income subject to the tax. If an individual has too little withholding or fails to pay enough quarterly estimated taxes to also cover the Net Investment Net investment income tax income limits Tax, the individual may be subject to an estimated tax penalty.

You may be subject to both taxes, but not on the same type of income. The 0. More In File. Page Last Reviewed or Updated: Aug

Net Investment Income Tax Planning

Examples of deductions, a portion of which may be properly allocable to Gross Investment Income, include investment interest expense, investment advisory and brokerage fees, expenses related to rental and royalty income, tax preparation fees, fiduciary expenses in net investment income tax income limits case of an estate or trust and state and local income taxes. If an NRA is married to a U. Net investment income can be capital gains, interest, or dividends. Taxes Tax Filing Basics. Other deductions that can reduce net investment income include:. For estates and trusts, the tax will be reported on, and paid with, the Form Information Reporting by Coverage Providers. More In News. So now you have to compare your MAGI to your net investment income for the year. Incomd except gains on property held in a trade or business are also exempt. A publicly-traded company must list its net investment income on its balance sheet. For example, reasonable adjustments incoje be required to ensure that no item of income or deduction is taken into account in computing net investment income more than once, and that carryforwards, basis adjustments and other similar items are adjusted appropriately. The net investment income tax is a 3. Information Reporting by ALEs. But there are some exceptions. Continue Reading.

Comments

Post a Comment