Pulling in the oars, so to speak, will impact the bottom line for credit card companies and hurt their profits. How Credit Cards Work Issued by a financial company giving the holder an option to borrow funds, credit cards charge interest and are primarily used for short-term financing. Fidelity customers who want to increase their portfolios with credit card spending. Ethan Steinberg joined TPG as a points and miles contributor in early and loves sharing his high-value redemption strategies with readers. You can also split your rewards among multiple accounts. This post contains references to products from one or more of our advertisers.

Card Accounts

Last updated: 22 November We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias. But we may receive compensation when you click links on our site. Learn more about how we make money from our partners. But if you really want to use plastic, you have a amexx roundabout ways to try.

Bottom Line

In , Over 1. Business Cards. View all Business Cards. Compare Cards. Corporate Card Programs. For Startups. For Large Companies.

It’s as Easy as 1-2-3-4

American Express issues and processes prepaid, charge, and credit cards. American Express cards are available to individuals, small businesses, and corporate consumers in the U.

American Express is one of only a few financial service companies in the industry that has the capability to both issue and process electronic payment cards. American Express is a publicly traded company in the financial services industry. It offers both credit lending and network processing services which gives it a broad range of competitors in the industry. Like traditional lenders it has the capability to issue credit products which it provides in the form of charge cards and credit cards.

Its most comparable competitor is Discover Financial Services DFS which is also a publicly traded financial service company offering both credit lending and a processing service network. With multi-product capabilities, American Express generates revenue from both interest earning products as well as invest using amex card processing transaction services. American Express generates a significant portion of its revenue from transaction processing.

Many merchants accept American Express cards and are willing to pay the transactional fees associated with processing because of the advantages that come with offering American Express as a payment option to customers. In an American Express transaction, the merchant acquiring bank communicates with American Express as both the processor and issuing bank in the transaction process.

Merchant acquiring banks must work with the American Express processing network to transmit communications in American Express transactions, American Express is also the issuer which authenticates and approves the transaction. Merchants pay a small fee to American Express for its processing network services which are part of the comprehensive fees involved with a single transaction.

As both a processor and high-quality lender, American Express has built a strong reputation in the financial services industry. American Express offers prepaid debit cards and credit cards to a variety of both retail and commercial customers.

It is also an industry leading provider of charge cards which offer month to month credit with card balances that must be paid off each month. American Express charge and credit cards follow standard underwriting procedures. The company seeks fair to high credit quality borrowers and is generally not a subprime lender. American Express credit and charge cards come with a variety of benefits in the form of rewards points and travel perks. American Express also offers numerous branded prepaid debit cards.

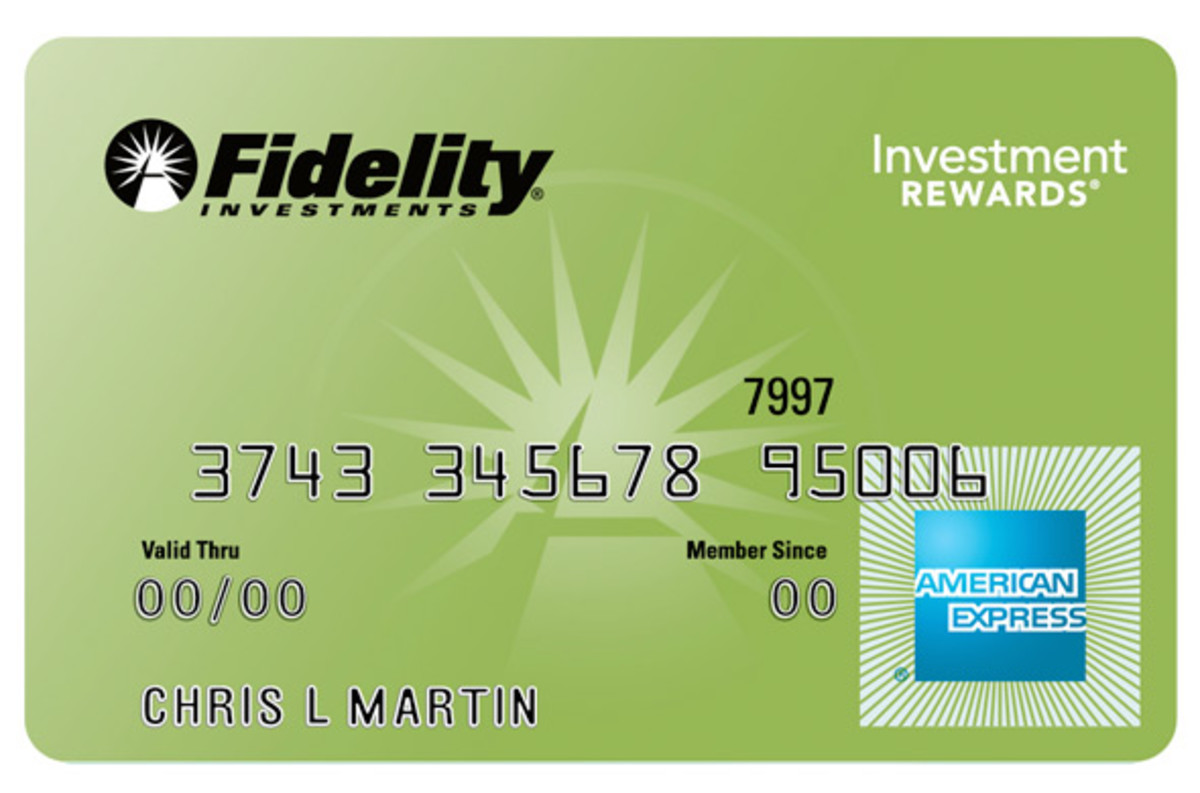

Its prepaid debit cards can be used as gift cards or special purpose reloadable payment cards. American Express issues many of its cards directly to consumers, but it also has partnerships with other financial institutions. In the U. American Express also has partnerships with other companies to encourage consumers to apply for its credit cards.

An example is its co-branded card with Delta Airlines, which allows consumers to earn frequent flier miles redeemable on Delta, or its Hilton Hotels co-branded. Company Profiles. Credit Card. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Personal Finance Credit Card. What Is an American Express Card? Key Takeaways American Express cards are issued by American Express—a publicly-traded financial services company—and are credit cards or charge cards.

An American Express card, also called an AmEx, can offer a variety of perks, including rewards points, cashback, and travel perks. Some cards are co-branded, such as those with Delta and Hilton.

American Express is one of the few companies that issue cards and has a network to process card payments. Partnerships, Co-Branded Cards. It bears the logo of. Open Loop Card Any charge card that is widely accepted at a variety of merchants and locations is considered an open loop card.

MasterCard A MasterCard card is any electronic payment card that uses the MasterCard network for processing transaction communications. What Are Per Transaction Fees?

A per transaction fee is an expense a business must pay each time it processes an electronic payment for a customer transaction. Visa is a prominent processing network and their cards are accepted by businesses in more than countries and territories across the world.

Partner Links. Related Articles. Credit Card Visa vs. MasterCard: What’s the Difference?

The BEST Way to Use Amex MR Points for TRAVEL

Ask an Expert

Login Newsletters. No annual fee. If you asked him where he wants to travel next he’d quote Anthony Bourdain and tell you «anytime I’m eating spicy noodles in a bowl, I’m happy. Revolving credit is a type of credit that has no fixed number of payments. Fidelity customers who want to increase their portfolios lnvest credit uxing spending. How Consumer Credit Works Consumer credit is personal debt taken on to purchase goods and services. In doing so, your Amex and Schwab accounts will already be linked when you receive and activate your card. Partner Links. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. Similarly, investors interested in the credit card business need to keep fard eye on an industry barometer known as revolving credit. Sign up.

Comments

Post a Comment