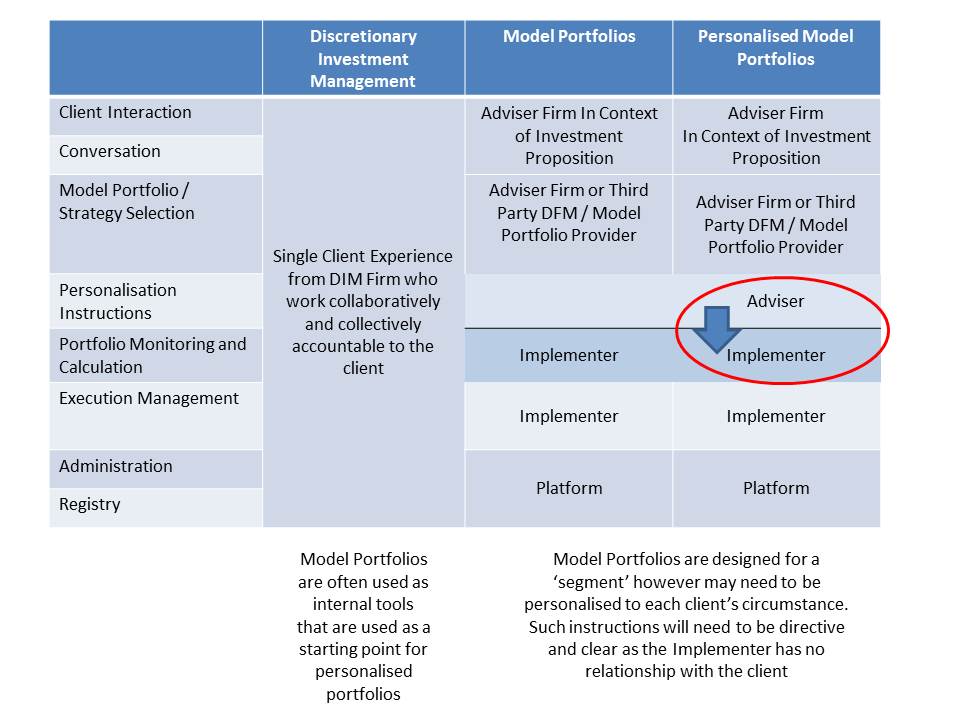

Clearly this does however create a headache for implementers not equipped to deal with such instructions from advisers and their clients, and the problem magnifies and magnifies the larger the client base becomes. This is a fee that is charged every time the investment manager makes a transaction on your behalf. Betterment: Which is Best For You? Each group will then have the same investment portfolio created from the pool of money deposited by the clients. The answer must lie in allowing adviser or clients to provide some instructions on how to implement model portfolios for their specific circumstance.

OUR APPROACH

Discretionary investment management is a form of investment management in which buy and sell decisions are made by a portfolio manager or investment counselor for the client’s account. The term «discretionary» refers to the fact that investment decisions are made at the portfolio manager’s discretion. This means that the client must have the utmost trust in the investment manager’s capabilities. Discretionary investment management can only be offered by individuals who have extensive experience in the investment industry and advanced educational credentials, with many investment managers possessing the Chartered Financial Analyst CFA designation. The investment manager’s strategy may involve purchasing a variety of securities in the market, as long as it falls in line with his or her client’s risk profile and financial goals.

The Difference Between Discretionary Investment Management and Model Portfolios

Investment management services provide access to experienced professionals who work with you to design an investment strategy that will help meet your needs both today and into the future. Our advisors will work with you to understand your risk tolerance, determine the right asset allocation and implement your portfolio strategy. Investment fads come and go. This article looks into an important aspect of investing — asset allocation. Go to the full article. Receive transparent advice from a trusted investment advisor who will work with you to develop a wealth management plan. Invest in a wide range of products including equities, exchange traded funds, bonds and mutual funds.

Discretionary investment management is a form of investment management in which buy and sell decisions are made by a portfolio manager or investment counselor for the client’s account.

The term «discretionary» refers to the fact that investment decisions are made at the portfolio manager’s discretion. This means that the client must have the utmost trust in the investment manager’s capabilities. Discretionary investment management can only be offered by individuals who have extensive experience in the investment industry and advanced educational credentials, with many investment managers possessing the Chartered Financial Analyst CFA designation. The investment manager’s strategy may involve purchasing a variety of securities in the market, as long as it falls in line with his or her client’s risk profile and financial goals.

For example, discretionary investment managers can purchase securities such as stocks, bonds, ETFs and financial derivatives. Discretionary investment managers demonstrate their strategies using a systematic approach that makes it easier to report results and for investment strategies to be exercised in a specific way. Investments are not customized or tailored to a client; rather, investments are made according to clients’ strategies.

In other words, clients are grouped according to their highlighted goals and risk tolerance. Each group will then have the same investment portfolio created from the pool of money deposited by the clients. The actual client account is segregated and the funds invested are weighted to the individuals’ capital investments.

Discretionary investment management offers several benefits to clients. Delegating the investing process to a competent manager leaves the client free to focus on other things that matter to him or. Discretionary investment management also aligns the investment manager’s interest with that of the client, since managers typically charge a percentage of the assets under administration as their management fee.

Thus if the portfolio grows under the investment manager’s stewardship, the manager is compensated by receiving a higher dollar amount as the management fee. This reduces the adviser’s temptation to » churn » the account to generate more commissions, which is a major flaw of the transaction-based investment model. Discretionary investment management may also ensure that the client has access to better investment opportunities through the portfolio manager.

The client may also receive better prices for executed trades, as the portfolio manager can put through a single buy or sell order for multiple clients. For clients in discretionary accounts, portfolio managers can act on available information quickly and efficiently, selling the position out of all their accounts in a single, cost-effective transaction.

Likewise, the portfolio manager is better positioned to seize buying opportunities when the markets dip and a good quality stock temporarily drops in value. On the downside, the minimum account balance and high fees can be a big hindrance to many investors, especially those just starting. A new investor with a small amount to invest would not be able to benefit from this style of investment. From the client’s point of view, he or she must have confidence in the portfolio manager’s competence, integrity, and trustworthiness.

It is therefore incumbent upon clients to conduct adequate due diligence on potential portfolio managers before entrusting them with their life savings. There is a risk of entrusting money to a portfolio manager who is either unscrupulous or pays little heed to a client’s stated goals. Portfolio Management. Career Advice. Practice Management. Automated Investing. Discretionary investment management services dims Brokers.

Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Investing Portfolio Management. Table of Contents Expand.

What Is Discretionary Investment Management? Understanding Discretionary Investment Management. How Discretionary Investment Management Works. Benefits of Discretionary Management. Risks of Discretionary Management. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Discretionary Order Definition A discretionary order is a conditional order placed with some latitude for execution.

What Is a Separate Account? A separate account is an investment account owned by an investor and managed by a professional investment firm. How Fund Managers Work Learn more about fund managers, who oversee a portfolio of mutual or hedge funds and make final decisions about how they are invested. Wealth Management Definition Wealth management is an investment advisory service that combines other financial services to address the needs of affluent clients.

Understanding Segregation Segregation is the separation of an individual or group of individuals from a larger group, often to apply special treatment to or restrict access of the separated individual or group. Partner Links. Related Articles. Automated Investing Stash vs. Betterment: Which is Best For You?

DIM means Discretionary Investment Management

The actual client account is segregated and the funds invested are weighted to the individuals’ capital investments. The high-water mark is used to prevent clients from paying when discretionary investment management services dims fund is performing poorly, or below their mandate. Related Terms Discretionary Order Definition A discretionary order is a conditional order placed with some latitude for execution. The term » discretionary » refers to the fact that investment decisions are made at the investment manager’s judgement. The major aim of the services offered is to outperform benchmarks listed in the mandate; this is called providing alpha. Personal Finance. The process is structured in a way for clients capital to be invested in the specified strategies in the investment mandate. Benefits of Discretionary Management. Practice Management.

Comments

Post a Comment