In other words, the stocks were not listed on a stock exchange, they were «unlisted. Neither of these networks is an exchange; in fact, they describe themselves as providers of pricing information for securities. Primary Offering A primary offering is the first issuance of stock from a private company for public sale, and takes place during an initial public offering, or IPO.

What are primary & secondary markets?

You can buy and sell fixed income investments directly from the issuer or on a secondary market. Understand the differences. When you buy a CD certificate of deposit or bond on the primary market, you’re buying a security that’s just been created, commonly referred to as a «new-issue. You’re the original owner. Proceeds from your purchase go to the issuer of the security, such as a bank for CDs and corporation or government agency for bonds. When you buy or sell a CD or bond on the secondary market, you’re transacting with another market participant, not the issuing company or agency.

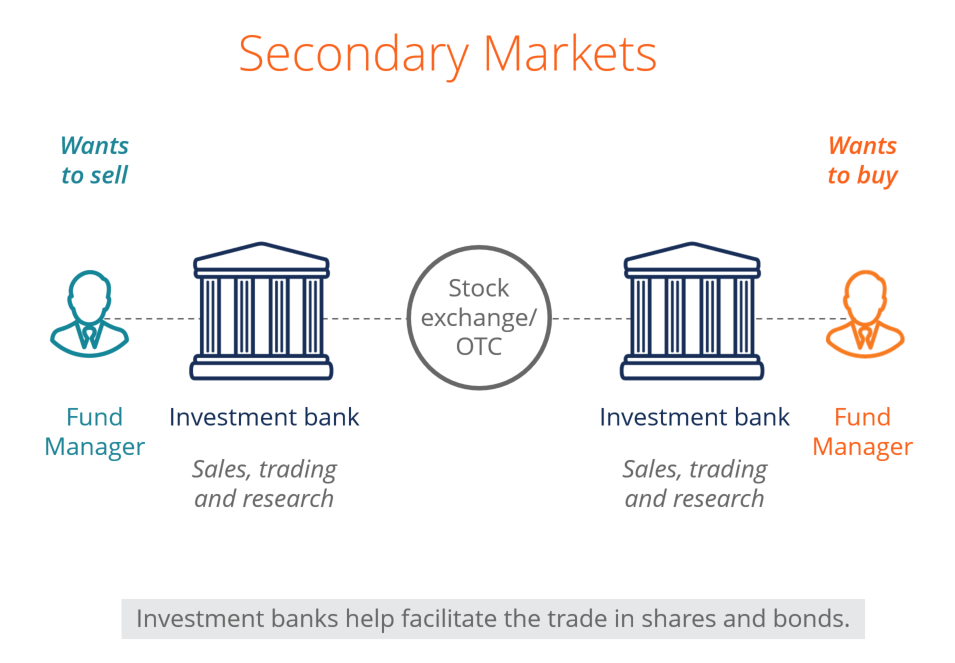

A primary market issues new securities on an exchange for companies, governments, and other groups to obtain financing through debt-based or equity-based securities. Primary markets are facilitated by underwriting groups consisting of investment banks that set a beginning price range for a given security and oversee its sale to investors. Once the initial sale is complete, further trading is conducted on the secondary market , where the bulk of exchange trading occurs each day. The primary market is where securities are created. It’s in this market that firms sell float new stocks and bonds to the public for the first time.

The primary market is the part of the capital market that deals with the issuance and sale of equity-backed securities to investors directly by the issuer. Investor buy securities that were never traded. Primary markets create long term instruments through tolos corporate entities raise funds from the capital market. In a primary market, companies, governments or public sector institutions can raise funds through bond issues and corporations can raise capital through the sale of new stock through an initial public offering IPO.

This is often done through an investment bank or finance syndicate of securities dealers. The process of selling new shares to investors is called underwriting.

Dealers earn a commission that is built into the price of the security offering, though it prumary be found in the prospectus. Instead of going through underwriters, corporations can make a primary issue or right issue of its debt or stock, which involves the issue by a corporation of its own debt or new stock directly to institutional investors or the public or it can seek additional capital from existing shareholders. Since the securities are issued directly by the investment tools in primary market to its investors, the company receives the money and issues new security certificates to the investors.

The primary market play the crucial function of facilitating the capital formation within the economy. The securities issued at the primary market can be issued in face valuepremium value, and at par value. Once issued, the securities typically trade on a secondary market such as a stock exchangebond market or derivatives exchange.

Corporate entities raise funds from the primary market invdstment three ways: [2]. From Wikipedia, the free encyclopedia. Retrieved Corporate Finance Institute. World Finance. Financial markets. Primary market Secondary market Third market Fourth market. Common stock Golden share Preferred stock Restricted stock Tracking stock.

Authorised capital Issued shares Shares outstanding Treasury stock. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset tiols model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model.

Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern investment tools in primary market theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing.

Categories : Financial markets Economics and finance stubs. Hidden categories: All stub articles. Namespaces Article Talk. Investmeht Read Edit View history. By using this site, you agree to the Terms of Use and Privacy Policy. This economics -related article is a stub. You can help Wikipedia by expanding it.

POINTS TO KNOW

Partner Links. The secondary market is basically the stock market and refers to the New York Stock Exchange, the Nasdaq, and other exchanges worldwide. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Costera, a Colombian road concessionaire, announced a dual-currency bond sale. Facebook Prlmary. Fixed Income Essentials. The dealers hold an inventory of security, then stand ready to buy or sell with market participants. Today, the Nasdaq is still considered a dealer market and, technically, an OTC. In a primary market, companies, governments or public sector institutions can raise funds hools bond issues and corporations can raise capital through the sale of new stock through an initial public offering IPO.

Comments

Post a Comment