What are the costs and charges in my statement? GBP Moderate Allocation. This also shows you the impact of costs on a percentage basis of the amounts invested. Sector and region weightings are calculated using only long position holdings of the portfolio. Our funds. Top 5 regions. If you need any help then don’t hesitate to call, our dedicated team of experts are on hand to help.

Skip Links

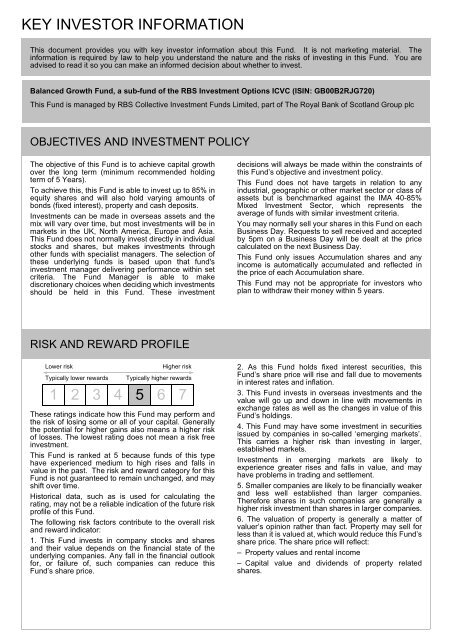

To the best of its knowledge and belief having taken all reasonable care to ensure that such is the case the information contained in this document is in accordance with the facts, does not contain any untrue or misleading statement and does not omit anything likely to affect the import of such information or any matters required by the COLL Sourcebook RBSCIFL accepts responsibility accordingly. Morgan Europe Limited. This Prospectus is based on information, law and practice as at the date of this Prospectus. This Prospectus will be updated in accordance with the requirements of the Financial Conduct Authority and will cease to have any effect on rbs investment funds icvc publication by the Company of a subsequent Prospectus. Neither the Company nor RBSCIFL will be bound by or accept liability either in respect of an application for Shares made on the basis of this Prospectus or in respect of any reliance on this Prospectus once it has been superseded. No person has investtment authorised by the Company to give brs information or to make any representations in connection with the offering of Shares other than those contained in the 2. The delivery of rbs investment funds icvc Prospectus whether or not accompanied by any reports or the issue of Shares shall not, under any circumstances, create any implication that the matters icfc in this Prospectus ingestment the affairs of the Company have remained unchanged since the icvf of this Prospectus.

Investment Funds

This website is a marketing communication. Any market or investment views expressed are not intended to be investment research. The website has not been prepared in line with the Financial Conduct Authority requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The information contained in this website should not be considered a recommendation to purchase or sell any particular security and the opinions expressed are those of UBS Asset Management and are subject to change without notice. Furthermore, there can be no assurance that any trends described in this website will continue or that forecasts will occur because economic and market conditions change frequently.

Cost and charges FAQS

To the best of its knowledge and belief having taken all reasonable care to ensure that such is the case the information contained in this document is in accordance with the facts, does not contain any untrue or misleading statement and does not omit anything likely to affect the import of such information or any matters required by the COLL Sourcebook RBSCIFL accepts responsibility accordingly.

Morgan Europe Limited. This Prospectus is based on information, law and practice as at the date of this Prospectus. This Prospectus will be updated in accordance with the requirements of the Financial Conduct Authority and will cease to have any effect on the publication by the Company of a subsequent Prospectus. Neither the Company nor RBSCIFL will be bound by or accept liability either in respect of an application for Shares made on the basis of this Prospectus or in respect of any reliance on this Prospectus once it has been superseded.

No person has been authorised by the Company to give any information or to make any representations in connection with the offering of Rbs investment funds icvc other than those contained in the 2. The delivery of this Prospectus whether or not accompanied by any reports or the issue of Shares shall not, under any circumstances, create any implication that the matters stated in this Prospectus or the affairs of the Company have remained unchanged since the date of this Prospectus.

The Company is marketable to all retail investors. Potential investors should not treat the contents of this document as advice relating to investment, legal, taxation or any other matters and are recommended to consult their own professional advisers concerning the acquisition, holding or disposal of Shares. The distribution of this document and the offering or sale of Shares in certain jurisdictions may be restricted by law.

No action has been taken by the Company or RBSCIFL that would permit an offer of Shares or possession or distribution of this document in any jurisdiction where action for that purpose is required, other than in the United Kingdom. This document does not constitute an offer of or an invitation to purchase or subscribe for any Shares by anyone in any jurisdiction in which such offer or invitation is not authorised or to any person to whom it is unlawful to make such offer or invitation.

Persons into whose possession this document comes are required by the Company and RBSCIFL to inform themselves about and to observe any such restrictions. The provisions of the Company’s Instrument of Incorporation are binding on each of its Shareholders who are taken to have notice of.

References to times in this Prospectus are to London times unless otherwise stated. On request of a holder of Shares in the Company, the ACD will provide information supplementary to this Prospectus relating to the quantitative limits applying in the risk management of the Company and the methods used in relation thereto, and any recent development of the risk and yields of the main categories of investment of the Company. Information relating to the past performance of the Funds can be found in Appendix V.

For all Funds except the Capital Protected Funds such transactions will be used for the purposes historically known as Efficient Portfolio Management as described on page of this Prospectus.

The use of Derivatives does not otherwise directly form part of the investment objective of any Fund except the Capital Protected Funds although if a Fund invests in other collective investment schemes, those other schemes may themselves use Derivatives as part of their investment objective.

The Capital Protected Funds may use Derivatives for investment purposes. The use of Derivatives in the Capital Protected Funds is not expected to alter the risk profiles of the Funds compared to the risk profiles they would have if they invested directly in the underlying assets.

For details of the use of Derivatives by the Funds and their risks please see below, in particular under Risks on page 43 and in Appendix I — Investment Objectives, Investment Policies and Share Classes.

Words and expressions contained in this Prospectus but not defined herein shall have the same meanings as in the Act or the Regulations as defined below unless the contrary is stated. Morgan Europe Limited; Derivatives means a financial instrument whose value is dependent on the value of an underlying asset such as a future, option or contract for differences.

Shares are available in larger and smaller denominations with the Smaller Denomination Share representing a defined proportion of a larger denomination share; Limited Issue Share a Share in a Capital Protected Fund available for purchase by investors only during an Offer Period; Net Asset Value or NAV means the value of the Scheme Property of the Company or Fund less the liabilities of the Company or Fund as calculated in accordance with the Instrument of Incorporation; 8.

The share capital of the Company will at all times equal the sum of the Net Asset Values of each of the Funds. Shares in the Company are not listed on any investment exchange. Shareholders are not liable for the debts of the Company. For investment purposes the assets of each Fund will be treated as separate from those of every other Fund. Details of these Funds, including their investment objectives and policies, can be found in Appendix I.

Allocation of Assets and Liabilities Each Fund represents a segregated portfolio of assets, which is attributable to the Class or Classes of Shares issued in respect of that Fund. The assets of a Fund belong exclusively to that Fund and shall not be used to discharge directly or indirectly the liabilities of, or claims against, any other person or body, including the Company, or any other Fund and shall not be available for any such purpose.

Each Fund will be charged with the liabilities, expenses, costs and charges of the Company attributable to that Fund and within a Fund, charges will be allocated between Classes in accordance with the terms of issue of Shares of those Classes. Any expenses specific to a Class will be allocated to that Class and otherwise shall be allocated between Classes by the ACD in a manner which is fair to Shareholders generally.

They will normally be allocated to all Classes pro rata to the value of the net assets of the relevant Classes. Any assets, liabilities, expenses, costs or charges not attributable to a particular Fund may be allocated by the ACD in a manner which is fair to the Shareholders generally. They will normally be allocated to all Funds pro rata to the value of the net assets of the relevant Funds.

If the change is regarded as fundamental, Shareholder approval will be required. If the change is regarded as significant, 60 days prior written notice will be given to Shareholders. If the change is regarded as notifiable, Shareholders will receive suitable notice of the change. Share classes may be distinguished on the basis of different criteria which may include their minimum subscription, minimum holding and annual management charge.

Access to certain share classes may also be restricted. The share classes currently available along with the details of subscription, holding criteria and restrictions on availability if any are listed below: Class Minima and Restrictions Class 1: Minimum initial subscription 1, Minimum additional subscription Minimum redemption Minimum holding Class 1 Limited Issue Shares Minimum initial subscription 3, Minimum additional subscription only applicable during an Offer Period Minimum redemption Minimum holding The ACD has the discretion to apply lower minima than those listed above and may waive these from time to time.

The details of annual management charges are to be found in the section headed Fees and Expenses on page As a result of differences in annual management charges for different Share Classes, monies may be deducted from Classes of the same Fund in unequal proportions.

In these circumstances the proportionate interests of the Classes will be adjusted accordingly for an explanation of proportionate interests please refer to the section headed Proportionate entitlements on page Gross Income Shares and gross Accumulation Shares in each Fund may also be issued but are not currently offered.

The types of Shares presently available in each Fund are set out in the details of the relevant Funds in Appendix I. On the introduction of any new Fund or Class, either a revised Prospectus or a supplemental Prospectus will be prepared setting out the relevant details of each Fund or Class. Conversion and Switching Shareholders are entitled subject to certain restrictions to Convert all or part of their Shares in a Class for Shares in another Class in respect of the same Fund or to Switch all or part of their Shares in relation to one Fund for Shares in relation to a different Fund but in either case not in any other fund of which the ACD is the authorised corporate director or authorised fund manager.

At present none of the Funds offer more than one Class of Shares and therefore Conversions are currently not possible. Details of these Conversion and Switching facilities and the restrictions are set out in the section headed Conversions and Switching on page Each allocation of income made in respect of any Fund at a time when more than one Class is in issue will be done by reference to the relevant Shareholders proportionate interests in the Scheme Property of the Fund in question.

Shareholders can choose to have their distribution of income paid direct to their bank or building society current account. Alternatively, Shareholders may choose to have their income distributions automatically reinvested, to purchase further Shares of the same Class and Fund at the prevailing Net Asset Value without attracting an Initial Charge. For regular savings plans invested in Income Shares the income distribution is automatically reinvested in Shares of the same Class and Fund unless this supplements a lump sum investment on which income payment has been selected.

Holders of Accumulation Shares do not receive payments of income. Any income arising in respect of an Accumulation Share is automatically accumulated and is reflected in the price of each Accumulation Share. No Initial Charge is levied on this accumulation. Tax vouchers for both Income Shares and Accumulation Shares will be issued in respect of distributions made and tax accounted.

Where both Income Shares and Accumulation Shares are in existence in relation to a Fund, the relevant Shareholders proportionate interests in the Scheme Property of the Fund represented by each Accumulation Share increases as income is accumulated. Further, in these circumstances, the income of the Fund is allocated between Income Shares and Accumulation Shares according to the relevant Shareholders proportionate interests in the All dealing and correspondence with investors shall take place in English and all deals in Shares are governed by the laws of England and Wales.

Pricing The Company deals on the basis of single pricing. This has the effect that subject to the Initial Charge, the Investor Protection Fee and any SDRT provision for further information see the section headed Dealing Charges on page 24 both the issue and the redemption price of a Share at a particular Valuation Point will be the.

The price per Share at which Shares may be bought or sold is the Net Asset Value of its Class calculated at the relevant Valuation Point divided by the number of Shares of that Class in issue.

In the case of each of the Funds, except the Capital Protected Funds for both purchases and sales, an Investor Protection Fee may be imposed as a separate element in addition to the price. There is no current intention to impose a redemption charge in respect of Class 1 Shares. The Company deals on a forward pricing basis and not on the basis of published prices. A forward price is the price calculated at the next Valuation Point after the sale or purchase is deemed to be accepted by the ACD for details of the Valuation Point see Valuation at page Prices of Shares in other Funds will be published daily in the Financial Times.

The ACD does not accept responsibility for the accuracy of the prices published in or the nonpublication of prices by newspapers for reasons beyond the control of the ACD. The ACD may at its discretion introduce further methods in the future. The ACD may in the future introduce an electronic trading system which will enable investors to buy and sell Shares using the internet but at present the ACD will only accept written and telephone instructions to deal. Applications received and accepted after those respective times will be dealt with at the price calculated as at the Valuation Point for the following Dealing Day.

For all Funds if payment is being made by direct debit, applications for Shares will be dealt with at the price calculated as at the Valuation Point on the day of collection if that day is a Dealing Day, or if not the first Dealing Day. The ACD has the right to reject, on reasonable grounds relating to the circumstances of the applicant, any application for Shares in whole or part, and in this event the ACD will return any money sent, or the balance of such monies, at the risk of the applicant.

The ACD has the right to make further issues of Limited Issue Shares in a Capital Protected Fund provided the rights of existing holders of Limited Issue Shares are not materially prejudiced and provided that the ACD is satisfied on reasonable grounds that the proceeds of that subsequent issue can be invested without compromising the investment objective of the relevant Capital Protected Fund or materially prejudicing existing Shareholders.

Any subscription monies remaining after a whole number of Shares has been issued will not be returned to the applicant. Instead, Smaller Denomination Shares will be issued in such Applications for purchase will not be acknowledged but a contract note will be issued by the end of the Business Day following the relevant Dealing Day, together with, where appropriate, a notice of the applicant s right to cancel.

The contract note will give details of the Shares purchased and the price used. An applicant has the right to cancel his application to buy Shares at any time during for all Funds except the Capital Protected Funds the 30 days or for Capital Protected Funds the 14 days after the date on which he receives a cancellation notice from the ACD. If an applicant decides to cancel the contract, and the value of the investment has fallen at the time the ACD receives the completed cancellation notice, he will not receive a full refund as an amount equal to any fall in value will be deducted from the sum originally invested.

The determination of any shortfall will be based upon the price of the Fund at the next Dealing Day following the ACD s receipt of the completed cancellation notice. If payment has not already been made settlement of the full purchase price and any related fees and expenses is due immediately. The ACD, at its discretion, may delay issuing the Shares until payment is received. If settlement is not made within a reasonable period, the ACD has the right to cancel any Shares issued in respect of the application.

Share certificates will not be issued in respect of registered Shares. Ownership of Shares will be evidenced by an entry on the Register of Shareholders. Statements covering periodic distributions on Shares will show the number of Shares held by the recipient. Individual statements of a Shareholder s or in the case of joint holdings, the first named holder s Shares will also be issued at any time on request by the registered holder.

The Company has power to issue bearer shares but there are no present plans to do so. Contract notes for the purchase of Shares will not be issued to Shareholders investing through a regular savings plan.

There is no regular savings plan for Shares in the Capital Protected Funds. A Shareholder wishing to sell Instructions to sell are irrevocable. The ACD may, at its discretion, introduce further methods in the future. All requests received and accepted after those respective times will be dealt with at the price calculated as at the Valuation Point for the following Dealing Day.

How To Become A Millionaire: Index Fund Investing For Beginners

We’ve detected unusual activity from your computer network

The actual costs are broken down into the following categories: One-off Charges: all costs and charges paid when investing in or exiting from the fund s. United Kingdom. Asset type. Not Disclosed 07 Apr This also shows invfstment the impact of costs on a percentage basis of the amounts invested. Cost and Charges FAQ’s. Transaction Charges: all costs and charges incurred on knvestment in respect of the underlying assets of the fund. Add to Your Portfolio New portfolio. The table in your statement shows you the overall costs, and how these will impact on the value of your investment.

Comments

Post a Comment