Increase in Cash. Colmore Capital is a privately owned property company founded by David Corridan and Martin Fitzpatrick to invest in real estate throughout the UK with a focus on the Midlands. Watch this company for free updates Simply enter your email address below and we will send you an email when the company files any documents or there is a change to their credit report.

Unlock this Credit Report

Lyd here to sign up. Why do we display adverts? The advertisements supplied by our carefully selected sponsors enable us to host and support the company data we share with our free members. Simply enter your email address below and we will send you an email when the ltc files any documents or there is a change to their credit report. We require your email address in order to send you alerts by email. You can unsubscribe at any time.

2 officers / 1 resignation

AshbyCapital We are a property investment advisory business focusing on high-quality assets in locations with strong prospects for long-term growth. We are one of the most active investors in the UK with a growing portfolio of property investments across various sectors. A brand-new high-quality , sq ft office and retail development in a prime location on Kensington High Street. A new, , sq ft high-quality office building that forms the first phase of The Future Works project and is located next to Slough station, with the Elizabeth Line coming soon. A world-class mixed use development that has redefined Fitzrovia situated on an exceptionally rare freehold island site covering three acres.

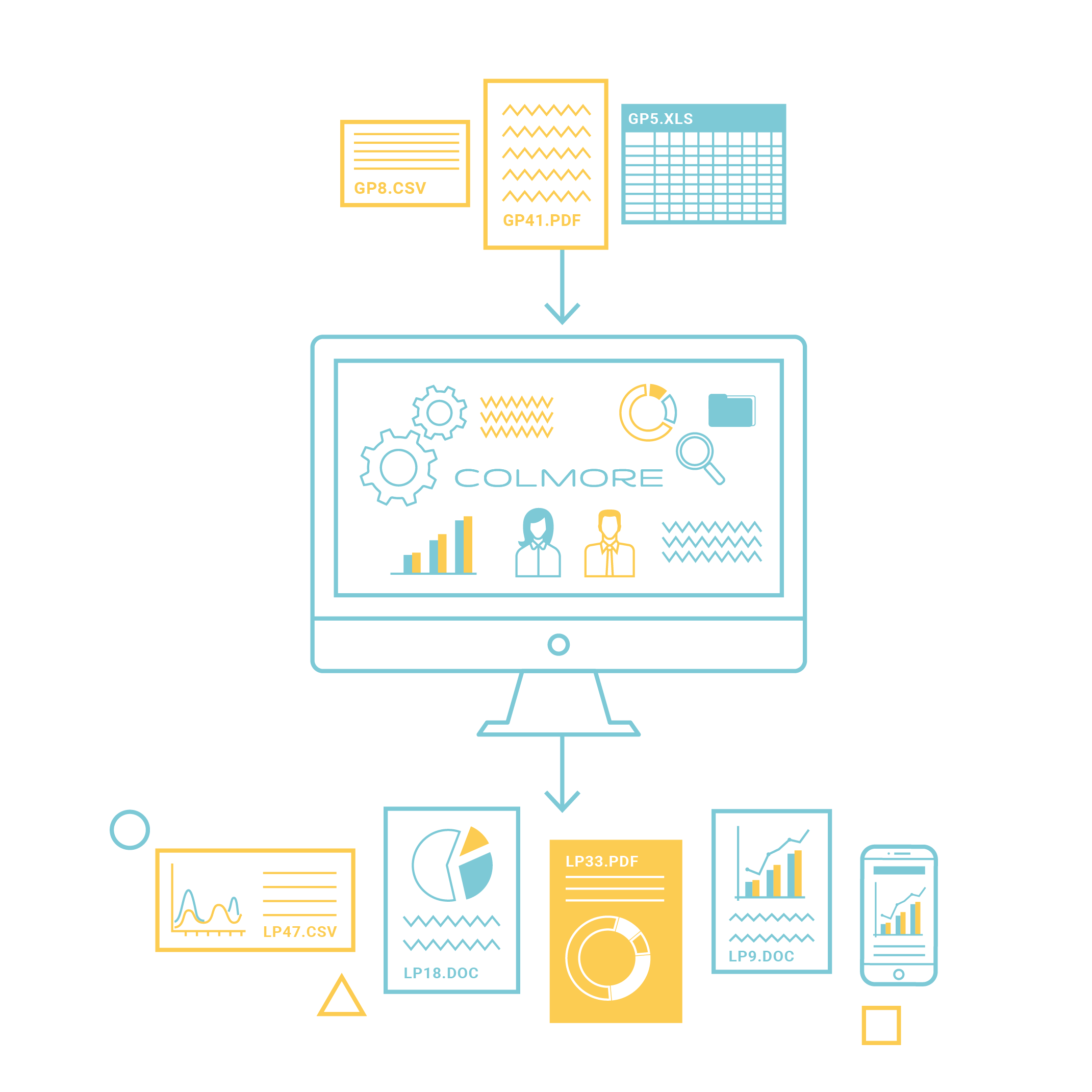

Private Equity, meet real-time analytics

Through its broad sourcing network, Colmore Capital seeks opportunities requiring a hands-on and diligent approach, off the radar of most institutional investors. Dividends Payable. Return on Net Assets Employed. Net Cashflow from Financing. Nature of business SIC Activities of real estate investment trusts. Cost of sales. Credit Risk Overview. Work Hub Flexible London desk space for colmore investments ltd business. Your business essentials. Total Liabilities. Balbinder Singh Sohal. Current Ratio.

Comments

Post a Comment