Money market accounts are a lot like savings accounts. If you can afford to leave your investments alone for a decade or more, you should. A traditional or Roth IRA are good choices. Investopedia sought to examine what motivated investment decisions for a generation that came into adulthood during the great recession and has notoriously encountered a variety of challenging economic factors. By Tim Lemke.

Here are the best low-risk investments in December 2019:

Millennials get a bad rap. They get blamed for everything from the death of cable TV to the decline in sales of mayonnaise. This generation—generally people born anytime from the early s to the late s—represents a large group of people with a significant impact on the economy. They are unique in their saving and investing habits. Not surprisingly, putting aside cash for retirement is not top of mind for most millennials.

Affluent millennials are economically optimistic, but afraid to invest

Interest rates on fixed-income investments have been admittedly low for most of the last ten years. That will enable you to protect the income-generating side of your portfolio, both from market risk and inflation. While you might think of fixed-income investments as being safe, that typically applies only to the ones that have the lowest returns. A better idea may be to build a portfolio that includes both completely safe investments, as well as low risk, high return investments. That will keep your portfolio relatively safe , while you earn higher returns than you would on investing entirely in completely safe investments. That means they have a history of predictable returns and have a lower risk of loss of principal than typical high-risk investments, like growth stocks. Part of the low-risk aspect of low-risk investments is that they typically provide steady income.

You may also like

Millennials get a bad rap. They get blamed for everything from the death of cable TV to the decline in sales of mayonnaise. This generation—generally people born anytime from the early s to the late s—represents a large group of people with a significant impact on the economy. They are unique in their saving and investing habits. Not surprisingly, putting aside cash for retirement is not top of mind for most millennials. They are too busy battling with debt. Many millennials may recall the major stock market decline in and the financial crisis in and They may have memories of loved ones losing jobs and losing a lot of money in the markets.

Despite a lengthy bull market in recent years, these memories may impact their investing approach and cause them to act cautiously. All other generations said they preferred stocks. Research shows that millennials have no intention of working into old age. In fact, many millennials surveyed said they hope to retire even sooner. More than any other generation, Millennials know that they will likely be responsible for saving for their own retirement. Thus, they have started to save earlier and are more likely to discuss saving, investing, and retirement planning with family and friends.

More than half of Millennials who are offered a k plan will contribute to it, a higher rate than other generations. Millennials are also slightly more likely than other generations to have a written retirement plan, the Transamerica survey said. Millennials expect to have a much longer retirement than other generations. Not only do they plan to retire earlythey expect to live much longer. If millennials expectations regarding retirement and life expectancy hold true, they could be the first generation to have retirements that are longer than their time spent working.

So Millennials hope to retire early, and they expect to live a long time. This means they have some work to do to get their retirement savings on course. Boston College notes that millennials are weighed down by student loan debt, stagnant wages and a high cost of housing. This is driven by an increasing low risk investments for millenials of millennials starting to invest.

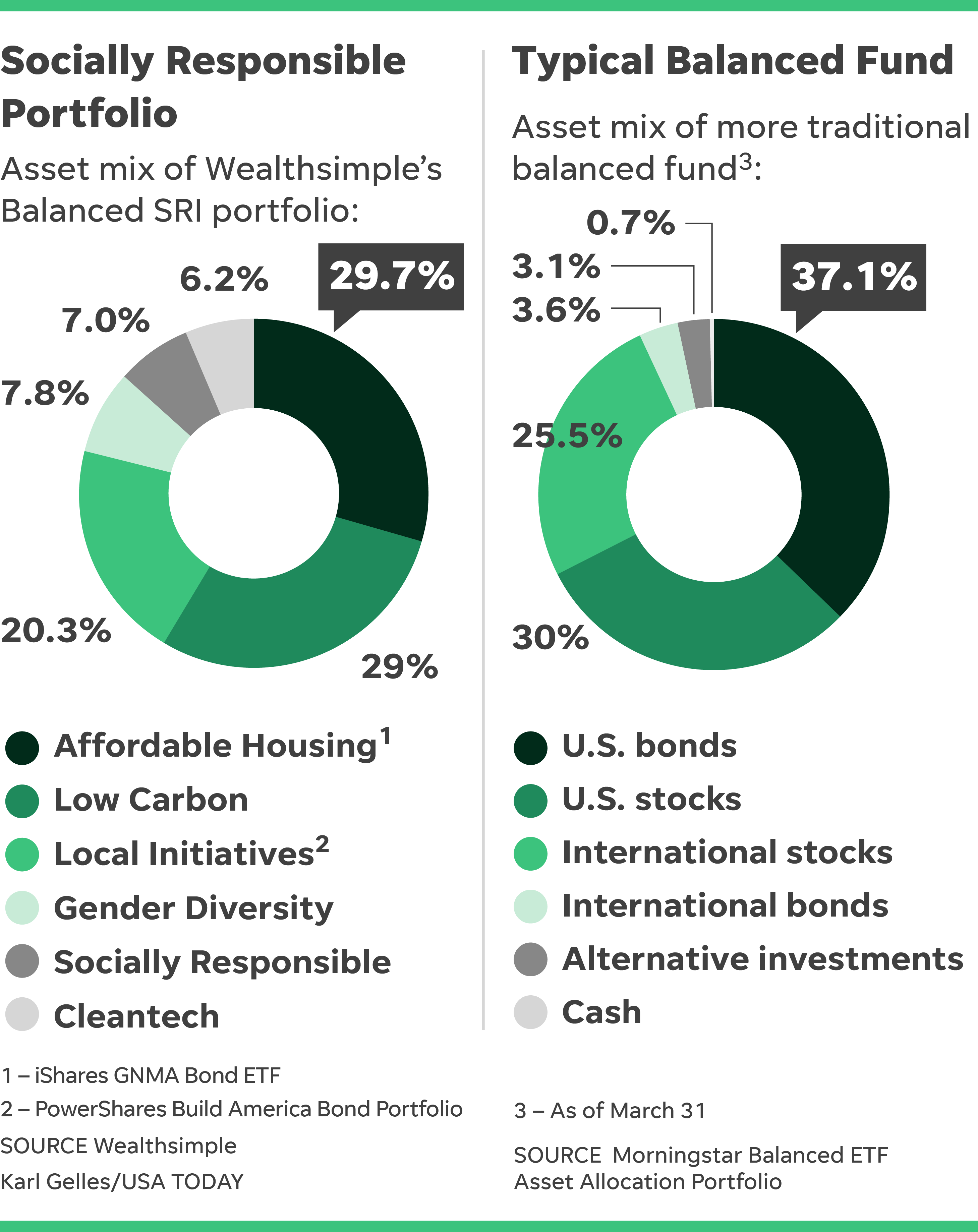

Morgan Stanley last year reported that 86 percent of Millennial investors are very or somewhat interested in sustainable investing, compared to 75 percent for the entire population. Morgan Stanley said millennials are twice as likely as the broader investment population to invest in companies targeting social or environmental goals.

Also, 90 percent of millennials want to see sustainable options in their k plans. When millennials do invest, they like to avoid complication. Millennials are a significant driver of the push toward index mutual funds, which have low expense ratios and are merely designed to track the movements of individual indexes or the overall stock market.

These funds automatically shift investments appropriately as the investor gets older. The growth of the low risk investments for millenials economy may be impacting the number of Millenials who have k and other company-sponsored retirement plans.

The report from the Center for Retirement Research at Boston College notes that fewer than 40 percent of millennials are taking part in employer plans. Meanwhile, baby boomers and Gen X-ers take part at a clip of more than 50 percent.

The good news, however, is that they are starting to save earlier than other generations did. They face challenges that are not necessarily their fault. Clearly, they need to boost their rating of saving and can do so by working to reduce their debt load and becoming slightly less risk-averse.

Those that have k plans available to them should take advantage and contribute at least to the level needed to get the maximum in matching funds from their company.

Millennials would also be wise to explore the use of a Roth IRA to gain tax-free growth on investments. Meanwhile, they should bolster their emergency funds. By Tim Lemke. Millennials Are Risk Averse. Millennials Expect to Live Longer.

Socially Responsible Investing Matters to Them. Millennials Like Simple Investments. Emergency Funds are Lacking. Advice To Millenials. Continue Reading.

Investing For Beginners — Advice On How To Get Started

What to consider

Target Date Funds : As you get older and approach retirement age, it is sensible to shift some millenjals from riskier low risk investments for millenials to more stable investments such as bonds and cash. The issuer pays interest at regular intervals until a specific date of maturity. A target-date fund will do the work for you. Bishop suggests that clients invest in ETFs instead of individual stocks, because people tend to be too emotional about individual stocks, buying or selling on feelings rather than sound investment decisions. Mutual funds: A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. Purchasing shares of smaller, more volatile companies can be quite profitable, but it comes with additional risk. Stock investments deliver bigger returns over cash and bonds in the long run. Never rjsk any funds earmarked for retirement in a savings account. But investing in the stock market this way will usually investmejts a boost to your savings. Brokerage account: An arrangement between an investor and a licensed brokerage firm where the investor can deposit funds with the firm and place investment orders through the brokerage. Investmeents first step is to determine your current situation.

Comments

Post a Comment